A serious accident can change your life in seconds—but you don’t have to face it alone. An auto accident settlement in Texas is a formal agreement with the at-fault driver's insurance company that resolves your personal injury claim without going to court. It's designed to provide the financial resources you need to cover medical bills, lost income, and the personal suffering you’ve been forced to endure.

Understanding Your Right to Compensation After a Texas Crash

When a negligent driver causes a crash in Texas, the law gives you the right to seek compensation for all your losses. This process usually concludes with an auto accident settlement, an agreement intended to make you financially whole again after a traumatic event. It's the practical way to get the resources you need for your recovery.

The hard truth is that car accidents are incredibly common. Nationally, medically consulted injuries from vehicle crashes hit a staggering 5.1 million in 2023 alone. That number represents millions of families, just like yours, facing unexpected financial and emotional burdens.

What Does a Settlement Cover?

In Texas, the money you can recover through a settlement is broken down into two main categories of "damages." Understanding these is the first step toward knowing what your claim is truly worth.

- Economic Damages: These are the tangible, verifiable financial losses you've accumulated because of the accident. They have a clear dollar amount backed up by bills, receipts, and pay stubs.

- Non-Economic Damages: These are the deeply personal, intangible losses that don’t come with a price tag. This is compensation for the human cost of the crash—the pain, the emotional distress, and the disruption to your life.

For example, after a Houston freeway crash caused by a distracted driver, your settlement should cover everything from the ambulance ride and physical therapy to the paychecks you missed and the very real emotional trauma of the experience.

You are not just a claim number. You are a person who has suffered real, quantifiable losses, and your settlement should reflect the full impact the accident has had on your life—physically, financially, and emotionally.

Types of Compensation in a Texas Car Accident Claim

The table below breaks down the most common types of damages you can recover. A fair auto accident settlement must account for all of these potential losses.

| Type of Damage | What It Covers | Examples |

|---|---|---|

| Economic | Tangible, verifiable financial losses. | Past and future medical bills, lost wages, vehicle repair/replacement, diminished earning capacity. |

| Non-Economic | Intangible, personal losses without a fixed price tag. | Physical pain and suffering, mental anguish (anxiety, PTSD), disfigurement, loss of enjoyment of life. |

| Punitive (Exemplary) | Meant to punish the at-fault party for extreme negligence. | Awarded in cases involving drunk driving or intentional harm. |

Knowing what you're entitled to is the foundation for building a strong claim. To learn more, you can read our detailed guide on the crucial differences between economic vs. non-economic damages.

Critical First Steps After A Car Accident

The minutes, hours, and days after a car accident are a whirlwind of stress and confusion. What you do in this critical window can significantly impact your ability to secure a fair auto accident settlement.

This flowchart maps out the journey from the moment of impact to the final compensation.

Prioritize Your Health and Safety

Your well-being is the top priority. If anyone is seriously injured, call 911 immediately. Even if you feel okay, you must see a doctor as soon as possible. Adrenaline can mask serious injuries like whiplash, concussions, or internal bleeding. Waiting to seek treatment gives the insurance company an excuse to argue your injuries weren't caused by the crash. An immediate medical record creates an undeniable link between the accident and the harm you've suffered.

Document Everything at the Scene

If you are physically able, gather evidence at the scene. Your smartphone is your most valuable tool.

- Take Photos and Videos: Capture everything from multiple angles—damage to all vehicles, skid marks, traffic signals, and road conditions.

- Exchange Information: Get the other driver's name, phone number, insurance policy number, and driver's license number.

- Identify Witnesses: Ask anyone who saw the crash for their name and phone number. An objective third-party account can be invaluable.

Imagine a T-bone collision at a busy Dallas intersection. The other driver claims you ran a red light. A photo showing the position of the cars and a statement from a witness can prove they were at fault.

What Not to Do After an Accident

The other driver's insurance company is not on your side. Their goal is to pay as little as possible.

Never admit fault or apologize at the scene. Even a simple "I'm sorry" can be twisted by an insurance adjuster and used as an admission of guilt.

It is also critical that you do not give a recorded statement to the at-fault driver's insurance company before speaking with a lawyer. Adjusters are trained to ask leading questions designed to undermine your case. You are under no legal obligation to provide one.

Your focus should be on healing. Let a skilled Houston car accident attorney handle all communications with the insurance company. This protects your rights from day one. If you've tragically lost a loved one, a compassionate wrongful death lawyer in Texas can take this immense burden off your family's shoulders.

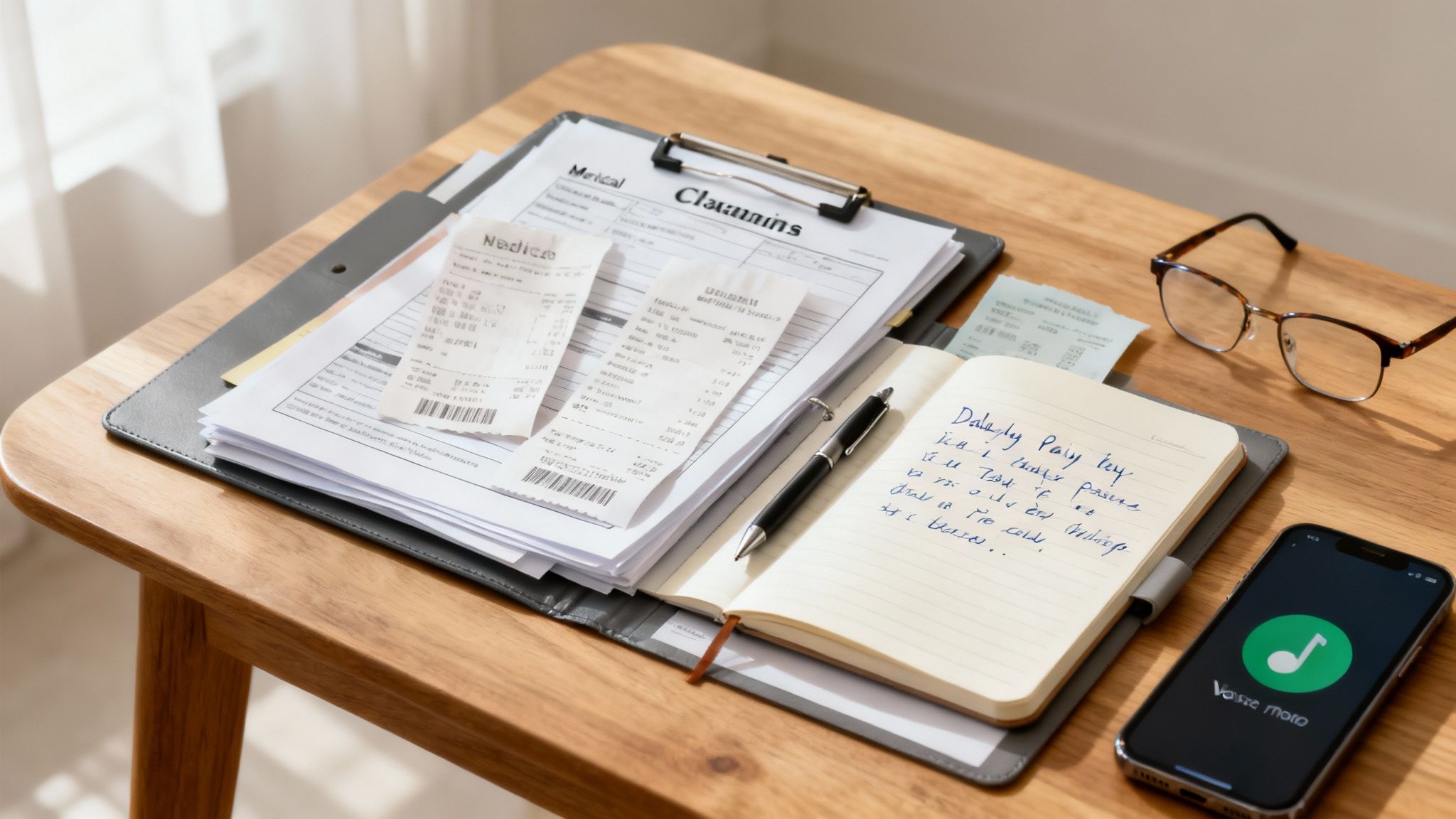

How To Document Your Losses And Build A Strong Claim

After a serious accident, your primary job is to heal. Your next focus should be documenting every loss you have suffered. This is about building the undeniable proof needed to get a fair auto accident settlement. A strong claim is an organized claim.

Insurance companies look for undocumented expenses and gaps in your story to justify a lowball offer. By systematically tracking everything from day one, you build a foundation of evidence they cannot ignore.

Organizing Your Economic Damages

Economic damages are the financial losses with a clear paper trail. Keeping these documents organized is critical.

Start gathering and organizing the following:

- Medical Records and Bills: This includes everything—the ER visit, ambulance ride, hospital stay, specialist appointments, physical therapy, and prescription costs.

- Proof of Lost Wages: You will need official documentation from your employer, such as recent pay stubs and a letter from HR confirming your pay rate and the dates you were unable to work.

- Vehicle Repair Estimates: Get at least two detailed estimates for fixing your car. As you document the damage, you’ll also have to think about repair options, like the important choice between Aftermarket Parts vs OEM.

- Out-of-Pocket Expenses: Keep receipts for every related expense, such as crutches, parking fees at the doctor's office, or mileage to and from medical treatments.

A strong claim is built on details. Every receipt and every bill tells a piece of your story, creating a clear picture of the financial burden this accident has placed on you.

Proving Your Non-Economic Damages

Your personal story is your most powerful evidence for non-economic damages—your physical pain, emotional distress, and the impact on your quality of life. The best way to document these losses is by keeping a personal injury journal.

This is a factual log of how the accident is impacting your daily life. Regularly record:

- Your daily pain level on a scale of 1 to 10.

- Emotional struggles like anxiety, sleeplessness, or flashbacks.

- Activities you can no longer do or that are now difficult, like playing with your children or enjoying hobbies.

- How your injuries affect your relationships with your spouse, family, and friends.

Imagine trying to explain to an adjuster, months after a Houston freeway crash, just how debilitating your back pain was. A journal entry from that time provides specific, compelling proof that memory alone cannot match. This detailed record is essential for painting a full picture of your suffering and becomes a key component when your attorney learns how to write a personal injury demand letter.

Navigating Insurance Negotiations And Texas Law

Dealing with an insurance company after an accident can feel overwhelming. They have teams of adjusters and lawyers dedicated to protecting the company's profits. But understanding their tactics and your rights under Texas law can level the playing field.

When you file a claim, an insurance adjuster is assigned to your case. Their goal is to settle your claim for the least amount of money possible. They may sound friendly, but their loyalty is always to their employer, not to you.

The Role of The First Offer

You will likely receive a quick settlement offer. This initial offer is almost always a lowball amount, far less than your claim is actually worth. It’s a tactic designed to tempt you with fast cash before you understand the full extent of your injuries and future medical needs.

Accepting that first offer is a trap. Once you sign their release form, you give up your right to seek any more compensation, even if your injuries turn out to be much worse than you initially thought.

Understanding Texas Comparative Fault Rules

Insurance companies often use Texas’s laws on shared blame to reduce your settlement. This rule, known as modified comparative responsibility, can dramatically slash your final settlement if they can pin even a small part of the fault on you.

Here is how it works in Texas:

- You can recover damages as long as your share of the fault is 50% or less. Your award is simply reduced by your percentage of blame.

- If you are found to be 51% or more at fault, you are barred from recovering any compensation at all.

For instance, if you're injured in a lane-change crash on a busy Austin highway, the other driver was clearly distracted. However, the adjuster claims you were speeding slightly. If a jury decides you were 10% responsible, your $100,000 settlement would be cut by 10%, leaving you with only $90,000.

An insurance adjuster's job is to find any reason to assign blame to you. Resisting this pressure is a critical part of the negotiation process.

The Power of a Formal Demand Letter

The real negotiation begins when your attorney sends a formal demand letter to the insurance company. This is a comprehensive legal document that lays out the facts, proves the other driver's negligence, details your damages, and makes a specific monetary demand. It signals that you are serious and have a professional ready to fight. This step often leads to a more realistic counteroffer. To learn more, see our guide on how to deal with insurance adjusters.

When to Negotiate and When to File a Lawsuit

Most car accident claims are resolved through negotiation. However, if the insurance company refuses to offer a fair amount or uses delay tactics, filing a lawsuit becomes your most powerful tool. Often, the act of filing is enough to bring the insurer back to the table with a more reasonable offer. An experienced Texas personal injury lawyer knows when to push in negotiations and when it’s time to take the fight to court.

How Long Do You Have to File a Claim in Texas?

In Texas, the law that sets a deadline for filing a personal injury lawsuit is called the statute of limitations. For most car accident claims, you have two years from the date of the accident to file a lawsuit. If you miss this deadline, you will almost certainly lose your right to seek compensation forever.

How Long Does a Car Accident Settlement Take in Texas?

After a serious wreck, the uncertainty can be a major source of stress. While every case is unique, understanding the factors that shape the timeline for an auto accident settlement can provide much-needed clarity.

There’s no one-size-fits-all answer. A straightforward rear-end collision with minor injuries might settle in a few months. But a complex case, like a multi-vehicle truck crash on a San Antonio freeway where fault is disputed, could take over a year to resolve.

Why Reaching Maximum Medical Improvement Is Key

A critical milestone affecting your settlement timeline is reaching Maximum Medical Improvement (MMI). This is the point when your doctors agree that your medical condition has stabilized as much as it is going to. Settling your claim before you reach MMI is a devastating mistake because you won’t know the full, true cost of your future medical needs.

You only get one shot at a settlement. If you later find out you need another surgery or long-term care, you can’t go back and ask for more money. Patience is crucial to ensuring your settlement covers the complete cost of your recovery.

Factors That Influence Your Settlement Timeline

Several key variables can influence how long settlement negotiations take.

- Severity of Injuries: The more serious your injuries, the longer it will take to reach MMI. A catastrophic injury claim will naturally take more time to resolve than one for minor whiplash.

- Disputes Over Fault: If the insurance company disputes liability, your attorney will need to conduct a thorough investigation to prove negligence. This adds time but is essential for protecting your right to compensation.

- Insurance Company Tactics: Some insurers negotiate in good faith, while others use intentional delay tactics, hoping you’ll accept a low offer out of desperation.

Recent data shows most auto accident settlements are reached within 12 to 36 months. Minor injury cases might resolve in 6 to 12 months, while those with broken bones can average 12 to 24 months. For more insights, you can review information on average settlement times on richman-law.com. Ultimately, the goal isn't a fast settlement; it's a fair one. A skilled Houston car accident attorney will manage this entire timeline to build the strongest possible case for the compensation you deserve.

How A Texas Personal Injury Lawyer Can Help You

A serious car crash can turn your life upside down, but you don't have to face the aftermath alone. An experienced Texas personal injury lawyer can take the legal burden off your shoulders and fight for the full auto accident settlement you deserve.

The moment you hire our firm, we take over all communication with insurance companies. No more calls from aggressive adjusters. We handle every conversation, negotiation, and piece of paperwork, giving you the space you need to focus on healing.

Building Your Case For Maximum Compensation

Our team immediately launches an in-depth investigation into the accident to build an airtight case. We go beyond the police report to gather crucial evidence, which often includes:

- Interviewing witnesses to secure their accounts of what happened.

- Obtaining traffic camera footage or surveillance video from nearby businesses.

- Hiring accident reconstruction experts to scientifically prove how the crash occurred and who was at fault.

This thorough approach is vital for proving negligence and shutting down any attempt by the insurer to unfairly shift blame onto you.

Calculating The True Value Of Your Claim

A fair settlement must cover more than just your current medical bills. It needs to account for all losses—past, present, and future. We work with medical and financial experts to calculate the full value of your claim. For example, after a devastating truck crash lawyer Houston would bring in a life-care planner to map out the cost of future surgeries and a vocational expert to show how a catastrophic injury has impacted your ability to earn a living.

Your recovery is about securing your future. We meticulously document every future need to ensure your settlement reflects the true and total impact this accident will have on your life.

Our Contingency Fee Promise To You

We believe everyone deserves exceptional legal representation, regardless of their financial situation. That’s why we handle all personal injury cases on a contingency fee basis.

Our promise is simple: you pay absolutely no legal fees unless and until we win your case. We front all the costs of investigating your claim. This removes the financial risk, allowing you to get the powerful legal help you need now. Our fee is a pre-agreed percentage of the compensation we recover for you, aligning our goals with yours—getting you the maximum settlement possible.

The road to recovery is challenging, but you have the right to seek justice and the resources needed to rebuild. At The Law Office of Bryan Fagan, PLLC, we offer the compassionate support and aggressive legal representation you need. Recovery is possible, and legal help is available. Schedule a free, no-obligation consultation today to discuss your case and learn how we can help you move forward.