A serious accident can change your life in seconds — but you don’t have to face the aftermath alone. When you receive compensation after a devastating injury, you'll face a critical decision: structured settlement vs lump sum. It’s a choice that will shape your family's future. A lump sum gives you all the money at once, offering immediate control. A structured settlement provides a stream of guaranteed, tax-free payments over time for long-term security.

There's no single right answer. The best path for you will depend on your personal needs, your ongoing medical care, and your goals for the future. Our goal is to provide the clarity you need to make a confident choice.

Choosing Your Path After a Texas Injury Settlement

A serious accident can change your life in a heartbeat, but the financial decisions you make next will define your future for years to come. After enduring the stress of negotiations and legal battles, figuring out how to receive your settlement is one of the most critical steps you'll take. At The Law Office of Bryan Fagan, PLLC, we understand the weight of this moment, and we're here to cut through the confusion and bring clarity to a tough time.

The financial weight of this choice is heavy, often feeling similar to figuring out what to do with an inheritance. You have to think carefully to make sure the money lasts. The first step is truly understanding the fundamental differences between your two main options.

Key Settlement Options at a Glance

Let's ground this in a real-world scenario. Imagine a family in Houston trying to piece their lives back together after a devastating truck crash. How they choose to receive their settlement funds will shape everything.

| Feature | Lump Sum Settlement | Structured Settlement |

|---|---|---|

| Payment Method | One single, upfront payment of the full settlement amount. | A series of guaranteed, periodic payments over a set time or for life. |

| Financial Control | Immediate and total control over the entire settlement fund. | Funds are managed by a third party and paid on a fixed schedule. |

| Long-Term Security | Depends entirely on your own financial management and discipline. | Provides a predictable, guaranteed income stream for future needs. |

| Tax Implications | The initial settlement is tax-free, but any investment gains are taxable. | All payments, including any growth, are completely tax-free. |

A structured settlement is often a lifeline for someone with long-term medical needs or a family who has lost their primary breadwinner. A lump sum, however, can be the better fit for those with significant immediate expenses and a solid plan for managing the money.

Recently, we've seen a definite shift in preference. Structured settlements have surged in popularity, with the total value of structured proceeds jumping by 58% in just two years. This trend, especially in the Texas personal injury cases we handle at The Law Office of Bryan Fagan, PLLC, shows that more and more families are choosing long-term financial stability over the risks that can come with a single large payment.

Understanding a Lump Sum Settlement

When you opt for a lump sum settlement, you receive the entire compensation amount in one single payment. This puts the full value of your settlement right in your hands, giving you immediate and total control over your financial future.

For many Texas families reeling from a serious accident, this instant access to cash is a powerful tool. It allows you to immediately tackle urgent financial burdens—paying off relentless medical bills, wiping out high-interest credit card debt, or making critical accessibility modifications to your home.

But that immediate control is a double-edged sword. It comes with a heavy dose of responsibility and some real risks you need to be ready for.

The Realities of Managing a Large Payout

Let's imagine a driver who survived a chaotic multi-car pile-up on a San Antonio freeway. They receive a large lump sum settlement, and it feels like a lifesaver. Without a solid financial plan, however, that lifeline can unravel quickly.

The temptation to make large, impulsive purchases can be overwhelming, especially after you've gone through something traumatic. You might also find friends or family asking for a "loan," which adds a layer of emotional pressure to an already stressful time. Without serious financial discipline, money that was meant to secure your future for life can vanish in just a few years, leaving you exposed when future expenses arise.

A lump sum settlement offers you the freedom to take control of your financial recovery on your own terms. But that freedom demands a clear, disciplined strategy to ensure the funds truly last for as long as you need them to.

Getting a handle on the long-term financial picture is absolutely vital. For anyone leaning this way, learning [how to invest a lump sum of money](https://blog.investogy.com/how to invest a lump sum of money/) isn't just a good idea—it's a critical step in protecting your future.

Tax Implications and Long-Term Planning in Texas

While a personal injury settlement itself is generally tax-free in Texas, any money you earn by investing it is not. If you place your settlement into a high-yield savings account, stocks, or other investments, the interest, dividends, or capital gains you make are considered taxable income by the IRS.

This is a crucial detail that many people miss. A smart investment strategy must factor in these future tax obligations to prevent unpleasant financial surprises down the road.

To protect your financial future with a lump sum, you should take these steps:

- Create a Detailed Budget: Map out all your current and future expenses. This includes ongoing medical treatments, daily living costs, and a buffer for emergencies. Think of your budget as your financial roadmap.

- Work with a Financial Advisor: A trustworthy financial professional can help you build a sustainable investment plan that fits your specific needs, comfort with risk, and long-term goals.

- Establish a Trust: Putting your settlement into a trust can add another layer of protection. It helps guard the money against mismanagement and outside pressures, making sure it’s used exactly as you intend.

Deciding to take a lump sum requires an honest look at your own financial discipline and a firm commitment to long-term planning. It’s also important to have a clear understanding of the settlement's total value, and you can learn more about how to calculate a car accident settlement in our detailed guide.

Understanding a Structured Settlement

When you hear the term “structured settlement,” think of it less like a single lottery win and more like a carefully planned financial safety net. Instead of getting your entire compensation in one lump sum, a structured settlement provides a steady, predictable stream of tax-free payments over several years—or even for the rest of your life.

This approach is all about ensuring your long-term security. For many Texas families we work with, especially those grappling with the aftermath of a devastating accident, just knowing that money will be there month after month provides incredible peace of mind.

These payment plans aren't a one-size-fits-all solution. They are negotiated and customized specifically for your family’s needs, creating a reliable source of income you can count on when it matters most.

How a Structured Settlement Works

The mechanics are straightforward but powerful. The defendant’s insurance company takes the settlement funds and purchases an annuity from a highly-rated life insurance company. An annuity is simply a financial product that guarantees a series of payments to you on a pre-determined schedule.

The payment schedule itself is incredibly flexible and can be designed to cover critical future milestones and expenses.

- Ongoing Medical Care: Payments can be scheduled to increase over time to keep pace with the rising costs of long-term medical treatments, therapies, or prescription drugs.

- Replacing Lost Income: The payments can mimic a regular paycheck, providing a stable income if you’re left unable to return to work after your injury.

- Future Life Goals: Funds can be scheduled to arrive in larger amounts at specific times, like when a child is ready for college or when you plan to pay off a mortgage.

This level of customization is vital for victims of life-altering incidents. For those facing a future with a permanent disability, learning what is considered a catastrophic injury is the first step, and locking down financial stability is the next. A structured settlement directly addresses this by creating a reliable financial foundation for the years ahead.

The Critical Tax Advantage

One of the single most significant benefits of a structured settlement is how it's treated by the IRS. Under Section 104(a)(2) of the Internal Revenue Code, all payments you receive from a personal injury structured settlement are 100% tax-free.

This isn't just the principal amount—it includes any growth or interest the annuity earns over time. This is a crucial distinction when comparing it to a lump sum, where any investment gains you make on your own would be considered taxable income.

This tax-free status isn't some loophole; it was intentionally put in place by the U.S. Congress to protect injury victims. The goal was to help prevent people from spending their awards too quickly and then needing public assistance down the line. In the Texas personal injury cases we handle, this provides a powerful advantage, ensuring every dollar is available for your recovery. You can find out more by reviewing these insights on structured settlements and their tax benefits.

Who Benefits Most from This Option

While every situation is unique, a structured settlement is often the smartest choice for individuals and families facing long-term financial uncertainty. It's an invaluable tool for:

- Victims with Permanent or Catastrophic Injuries: If you require lifelong medical care, a structured settlement ensures the funds will be there to cover those costs for as long as you need them. No questions asked.

- Families in Wrongful Death Cases: For a family that has tragically lost a primary earner, these payments can replace lost income and provide financial stability for a surviving spouse and children. A Texas wrongful death lawyer can help secure this future for you.

- Minors or Young Adults: A structured plan protects a young person’s settlement, ensuring the funds are used responsibly for their education and future well-being rather than being spent too quickly.

Choosing a structured settlement is a decision to prioritize guaranteed, long-term security over immediate access to a large sum of cash. It provides a shield against poor financial decisions, market volatility, and unforeseen pressures, giving you the freedom to focus on what truly matters—healing and rebuilding your life.

Comparing Your Settlement Options Side by Side

Choosing between a structured settlement and a lump sum can feel overwhelming, especially when all you want to do is focus on getting better. To make things clearer, it helps to see the two options laid out side-by-side, focusing on what really matters for Texas families recovering from a serious accident.

This straightforward comparison is designed to help you quickly grasp the core differences in financial security, flexibility, and the risk protection each path offers.

Structured Settlement vs Lump Sum: Key Differences for Texas Victims

Understanding these distinctions is the first step toward making a confident decision that truly aligns with your family’s long-term needs and goals. Below is a direct comparison to help you weigh your options.

| Feature | Lump Sum Settlement | Structured Settlement |

|---|---|---|

| Financial Security | Your security depends entirely on your own financial management and discipline. It is vulnerable to market risks and poor investment decisions. | Provides guaranteed, predictable income for a set period or for life, shielding you from market volatility and ensuring funds are always there. |

| Flexibility | Offers maximum immediate flexibility. You can use the entire fund right away for large expenses like buying an accessible home or paying off debts. | Less flexible once established. The payment schedule is fixed, and you cannot access large sums of money on demand for unexpected needs. |

| Tax Implications | The initial settlement is tax-free, but any gains from investing the money are taxable income. This can significantly reduce your net returns over time. | All payments you receive, including any growth from the annuity, are 100% tax-free under federal law, maximizing the value of your settlement. |

| Protection from Risk | Puts you at higher risk of mismanaging funds, facing pressure from others for money, or losing the settlement to impulsive spending or bad investments. | Protects your settlement from outside influences, creditors, and mismanagement. It ensures the money lasts for its intended purpose—your future care. |

Making the right choice starts with knowing exactly what you're getting into with each option.

Financial Security: A Deeper Look

With a lump sum, you become the sole guardian of your financial future. That path requires a rock-solid plan and unwavering discipline.

A structured settlement, on the other hand, has that security built right in. The payments are backed and guaranteed by highly-rated life insurance companies. This provides a reliable financial foundation you can build your life on without losing sleep over market downturns or investment performance.

Flexibility in a Real-World Scenario

Flexibility is often the biggest selling point for a lump sum, but it's crucial to think about what that means in practice.

Imagine a construction worker who was seriously injured in a Houston truck crash and now needs major modifications to their home to accommodate a wheelchair. A lump sum could provide the $100,000 needed for that right away. However, he also faces a lifetime of medical appointments and knows he can never return to his physically demanding job.

This is where a hybrid approach can be a powerful solution. You can negotiate to receive an initial lump sum for immediate needs—like home modifications and paying off accident-related debts—while placing the remainder into a structured settlement. This gives you the best of both worlds: upfront cash for urgent costs and guaranteed, tax-free income for long-term security. A skilled truck crash lawyer in Houston can help negotiate this type of arrangement.

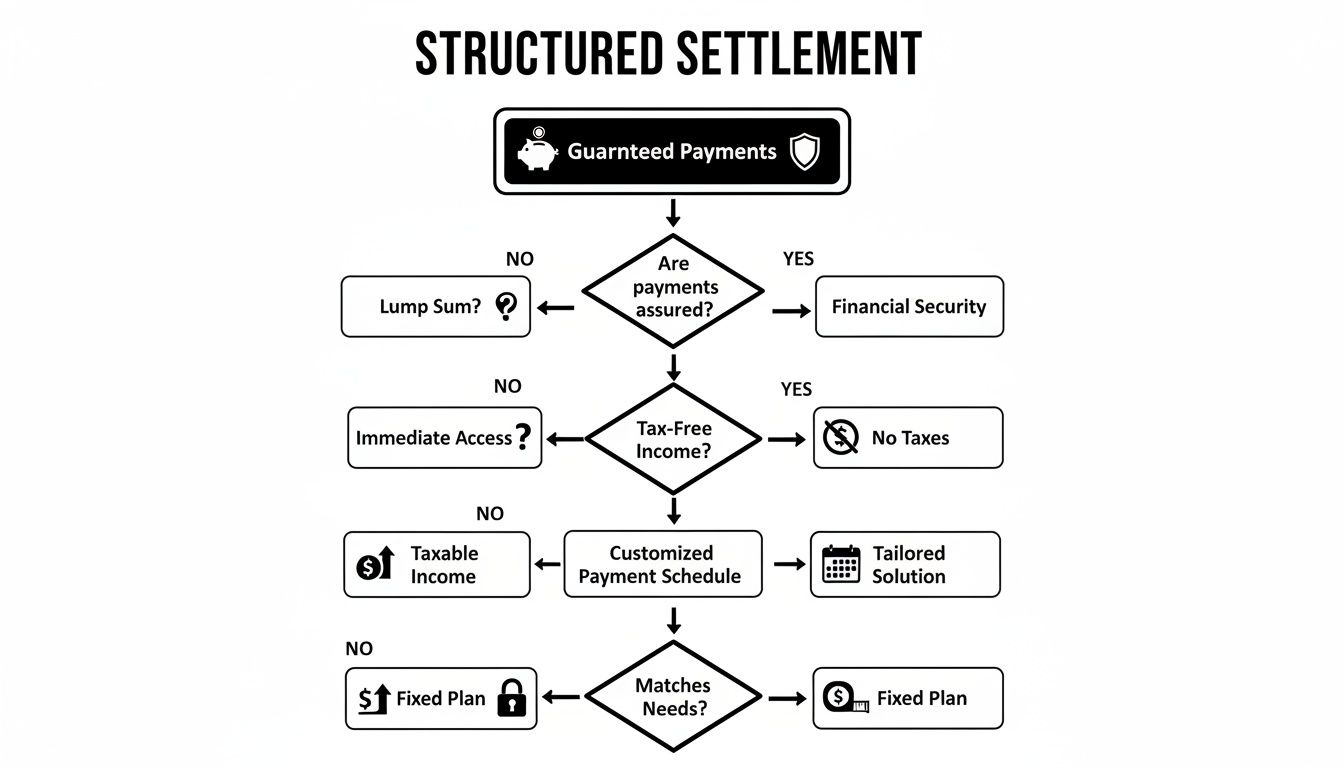

Understanding the Visuals of a Structured Settlement

This flowchart breaks down the core benefits of a structured settlement, visualizing the guaranteed, tax-free, and customized nature of these payment plans.

As the graphic shows, every element is designed to provide stability and peace of mind, protecting your settlement for the long haul. This is a sharp contrast to the risks and heavy responsibilities that come with managing a single, large payment on your own. Deciding which path is right for you depends entirely on your unique circumstances, from the severity of your injuries to your personal comfort level with managing money.

Deciding Which Settlement Option Is Right for You

The truth is, there's no magic formula for choosing between a structured settlement and a lump sum. The right answer is deeply personal. It comes down to your family’s specific needs, your financial comfort level, and what will ultimately give you the most security and peace of mind.

To help you see how these choices play out in the real world, let's walk through a few scenarios we often see with our clients here in Texas. Grounding this decision in relatable stories can make it much clearer which path might be the right fit for your life.

When a Lump Sum Might Be the Right Choice

Picture a skilled electrician from Dallas who was hurt in a rear-end collision on the freeway. His injuries were moderate, and while he's facing a few months of physical therapy, his doctors are confident he'll make a full recovery and get back to work. He's always been good with money and has a long-held dream of starting his own electrical contracting business.

For him, a lump sum settlement could be the perfect tool. Here’s why it works:

- Manageable Future Needs: His medical costs, while significant, are finite. He isn’t facing a lifetime of unpredictable medical bills.

- Financial Experience: He has a solid history of managing his family's finances and feels confident handling a large amount of money responsibly.

- A Clear Investment Goal: His plan is straightforward: use part of the settlement to wipe out all his accident-related debts and invest the remainder to launch his business. This turns his settlement into a new source of income for his family.

In a situation like this, the immediate control and flexibility of a lump sum empower him to rebuild his financial future on his own terms.

When a Structured Settlement Provides a Lifeline

Now, let's consider a much more challenging scenario. After a Houston freeway crash, a family is grappling with the aftermath of a catastrophic injury. Their minivan was hit by a commercial truck, leaving the mother with a severe traumatic brain injury. She now requires around-the-clock care and will never be able to work again.

For this family, a structured settlement isn't just a good option—it's a vital lifeline.

Choosing a structured settlement in a catastrophic injury case isn't about giving up control; it's about gaining certainty. It ensures that no matter what the stock market does or how long care is needed, the funds to protect your loved one will always be there.

The predictable, tax-free payments create a powerful safety net for them:

- Lifelong Medical Care: The payments are specifically designed to cover her ongoing medical treatments, in-home nursing care, and therapies for the rest of her life.

- Income Replacement: The settlement replaces her lost income, giving the family the financial stability they need to keep their home and support their children.

- Protection and Peace of Mind: The family is freed from the immense burden of managing a large investment portfolio while also navigating the emotional and physical demands of caregiving.

Exploring a Hybrid Settlement Option

You don’t always have to pick one extreme over the other. In many cases, the most practical solution is a hybrid settlement that combines the strengths of both approaches.

Let’s return to the family dealing with the catastrophic truck crash. They have immediate, overwhelming needs. Medical bills have piled up, they need to buy a wheelchair-accessible van, and they want to pay off the high-interest credit card debt they took on while the mother was hospitalized.

A skilled Texas personal injury lawyer can negotiate a settlement that provides an upfront lump sum to cover these urgent costs right away. The rest of the settlement funds are then placed into a structured annuity, guaranteeing all their future needs are met with tax-free payments. This hybrid model offers the perfect balance of immediate relief and long-term security, making it a powerful choice for many Texas families.

How a Texas Personal injury Lawyer Can Guide You

You shouldn't have to face this monumental decision on your own. While your focus needs to be on healing, the complex financial questions surrounding a structured settlement vs lump sum can feel completely overwhelming. An experienced Texas personal injury lawyer does much more than just fight insurance companies; we are your trusted advisors through every single step of this process.

Our goal is to make sure the final decision is one you feel confident and secure about for years to come. At The Law Office of Bryan Fagan, PLLC, our compassionate approach means we're here to provide clarity and direction during what is often a very difficult time.

How We Help From Negotiation to Financial Planning

Our first priority is always to fight for the highest possible settlement for your injuries. A skilled Houston car accident attorney will aggressively negotiate with the at-fault party's insurance company to secure the maximum compensation you deserve. That number sets the foundation for your entire financial recovery.

Once a settlement amount is reached, our guidance shifts to helping you understand how each payment option truly impacts your future. We don't just present the choices; we help you analyze them from every angle.

We believe an empowered client is a protected client. Our job is to translate complex legal and financial options into clear, practical advice, so you can make the choice that best safeguards your family's future.

This involves a detailed, personal review of your specific circumstances and long-term needs. We'll discuss Texas's fault-based system, including how concepts like negligence and comparative responsibility impact your case, and explain the statute of limitations—the deadline you have to file a claim.

Connecting You with the Right Experts

While we provide the legal framework, we also recognize the importance of specialized financial advice. Part of our commitment to you is connecting you with trusted financial experts who can create detailed models and projections based on your life.

These professionals can illustrate exactly what your future might look like with a lump sum versus a structured settlement. They will help you answer critical questions, such as:

- How will a lump sum investment realistically perform over 20 or 30 years?

- Can a structured settlement be customized to cover future college tuition or major medical milestones?

- What are the long-term tax implications of each choice for your family?

Our team works right alongside these experts to ensure the legal agreement perfectly reflects the financial plan you choose. We also ensure total transparency in our own work; you can learn more about how we handle accident lawyer fees to see our commitment to your financial well-being.

Ultimately, whether you are recovering from a catastrophic injury or navigating a wrongful death claim, our goal is to provide the support you need to move forward with confidence. We handle the legal complexities so you can focus on what matters most: healing.

Common Questions About Texas Settlement Options

Making a decision about your settlement brings up a lot of important questions. After a serious accident, you need clear, practical answers. Here are some straightforward answers to the questions we hear most often from our clients at The Law Office of Bryan Fagan, PLLC, as they weigh a structured settlement against a lump sum.

Can I Change My Mind After Picking a Settlement Option?

No. Once that settlement agreement is signed, it is legally binding. The payment structure is locked in and can’t be reversed. This is precisely why it’s so critical to get this right the first time. You need to carefully review every angle with an experienced Texas personal injury lawyer before you sign anything. This choice will shape your financial reality for years, sometimes even decades.

What if I Have a Structured Settlement but Suddenly Need a Lot of Money?

This is a really common and practical concern. Life is unpredictable. While structured settlements are built for stability and aren't flexible by design, you aren't completely stuck if a real emergency hits. You have the option to sell some or all of your future payments to what's known as a factoring company in exchange for a discounted lump sum.

But—and this is a big but—this isn't a simple transaction. The process is tightly regulated by both Texas and federal law to protect people just like you. A judge has to approve the sale after determining it's truly in your best interest. Think of it as a last resort, not a simple cash-out plan.

What if the Insurance Company Funding My Structured Settlement Goes Under?

It's a scary thought, but it's also an extremely rare scenario. There are powerful safeguards in place. Structured settlements are only funded by highly-rated life insurance companies that have to meet very strict financial stability standards.

On top of that, these annuities have another layer of protection: state guaranty associations. These groups act like a safety net. If an insurer were to somehow fail, the association would step in to ensure your payments continue just as promised. It's a level of security you simply don't have when managing a large sum of cash on your own.

Is a Hybrid Settlement Ever the Best Choice?

Absolutely. In fact, a hybrid settlement is often the most practical and powerful solution for many families. It gives you the best of both worlds by combining an upfront lump sum with a stream of future structured payments.

- Handle Immediate Needs: The initial lump sum can wipe out pressing medical debt, pay for necessary home modifications after a catastrophic injury, or eliminate high-interest loans you had to take out to stay afloat.

- Secure the Future: The rest of the money goes into a structured settlement, creating a guaranteed, tax-free income stream to cover ongoing medical care, make up for lost wages, and provide long-term stability.

A perfect example is a family navigating a wrongful death case. They might use the lump sum to cover funeral costs and pay off the house, while the structured payments ensure the surviving spouse has a steady income and the children's education is funded. This balanced approach provides both immediate relief and lasting peace of mind.

A serious injury can make you feel like you've lost control. Making a smart, confident settlement decision is one of the most powerful ways to take that control back. You don’t have to figure it out alone. The experienced and compassionate attorneys at The Law Office of Bryan Fagan, PLLC are here to provide the guidance you need. We will fight for the maximum compensation you deserve and help you choose the path that best protects you and your family. We want you to know that recovery is possible and legal help is available. Schedule your free, no-obligation consultation today and let us help you move forward.