A serious accident can change your life in seconds—but you don’t have to face it alone. Getting into a car wreck is traumatic enough. But the shock gets so much worse when you find out the driver who hit you doesn't have insurance.

How are you supposed to pay for your medical care? How will you fix your car? We want you to know you're not alone, and you have options. Understanding your rights and next steps is the first step toward reclaiming control.

Your Guide to Navigating an Accident with an Uninsured Driver

Uninsured motorist coverage in Texas is a specific part of your own car insurance that pays for your medical bills and property damage if you're hit by a driver with no insurance. It also kicks in if the driver who hit you takes off—a classic hit-and-run.

Think of it as a critical safety net. Your own policy steps up to cover the costs that the at-fault, uninsured driver should have paid. This ensures you aren’t left holding the bag for overwhelming expenses after a crash you didn't cause.

Why This Coverage Is a Lifeline in Texas

This guide is for anyone who's been the victim of one of these frustrating and frightening accidents. We'll walk you through exactly what uninsured motorist (UM) coverage is, why it's a non-negotiable safety net for every Texas driver, and the practical steps you need to take to protect yourself.

Simply put, your own insurance company steps in to do the job the other driver's insurance was supposed to do. This allows you to focus on getting better without the threat of financial ruin hanging over your head.

A collision can change your life in seconds—but you don’t have to face it alone. Understanding your insurance coverage is the first step toward reclaiming control and securing the resources you need to heal.

Whether you're dealing with a minor fender bender or a catastrophic injury from a wreck on a Houston freeway, your UM policy is there to back you up. It helps cover expenses that can become unmanageable in a hurry, including:

- Emergency room visits and hospital stays

- Ongoing medical treatments and physical therapy

- Lost wages from being unable to work

- Pain and suffering caused by your injuries

At The Law Office of Bryan Fagan, PLLC, our experienced Texas personal injury lawyers are here to help you make sense of your policy and fight for every penny you deserve.

Why Every Texas Driver Needs This Essential Protection

Relying on other drivers to follow the law is a massive gamble, especially on Texas roads. We all hope the person in the next lane is just as responsible as we are, but reality often tells a different story. This isn't just a random worry; it's a real, daily risk on congested highways like I-45 in Houston or I-35 cutting through Austin and Dallas.

The unfortunate truth is that you’re more likely to get into a wreck with an uninsured driver here in Texas than almost anywhere else. This creates a huge, dangerous gap in protection for responsible drivers like you who do the right thing and carry proper insurance. If someone without coverage plows into you, who pays for your medical bills, your lost paychecks, and your car repairs? Without the right protection, the answer could be you.

The Alarming Reality of Uninsured Drivers in Texas

Between economic pressures and the rising cost of insurance, a staggering number of drivers are on the road illegally without the minimum liability coverage required by law. This isn't some minor issue—it's a widespread problem with devastating consequences for accident victims and their families.

The latest data paints a grim picture. Texas has consistently been one of the worst states in the country for uninsured drivers. According to a 2025 WalletHub study that analyzed 52 different safety metrics, Texas ranked dead last—50th out of 50 states—for its percentage of uninsured drivers. It's a systemic problem that puts you and your family at direct financial risk every time you get behind the wheel.

This means your odds of being hit by someone with absolutely no ability to pay for the damage they cause are dangerously high.

How One Crash Can Lead to Financial Devastation

Let’s walk through a real-world example that happens all too often. Imagine you're driving home from work on Loop 610 in Houston when a distracted driver blows through a red light and T-bones your car. You end up with a broken leg and a concussion, which means an ER visit, surgery, and weeks of painful physical therapy. On top of that, your car is totaled, and you can't work for two months.

The costs pile up fast:

- Medical Bills: $45,000

- Lost Wages: $8,000

- Vehicle Replacement: $25,000

Normally, you'd file a claim against the at-fault driver's insurance. But when the police report comes back, you learn the driver had no insurance at all. Just like that, you’re staring at $78,000 in losses with no clear way to get that money back. The other driver is legally responsible under Texas negligence law, but they likely have no assets to pay a judgment. You're left holding the bag.

This is the exact moment where Uninsured Motorist (UM) coverage becomes your financial lifeline. It steps in to cover the costs that the at-fault driver should have paid, shielding you from the consequences of their recklessness.

Without UM coverage, your options are limited. Your health insurance might cover some of the medical bills (after you pay your deductible and copays), but it won’t touch your lost income, pay for your totaled car, or give you a dime for your pain and suffering.

Choosing to carry enough UM coverage is one of the most critical financial decisions you can make to protect your family. To figure out the right amount for your situation, you can learn more about how much uninsured motorist coverage to carry in Texas.

How UM and UIM Coverage Actually Work for You

When you hear insurance terms like "Uninsured Motorist" and "Underinsured Motorist," it’s easy for your eyes to glaze over. Let's cut through the jargon. Think of this coverage less like a complicated policy and more like a personal financial bodyguard that steps in after a crash you didn't cause.

This protection is designed to fill a dangerous gap left by irresponsible drivers, making sure you aren't left holding the bag for someone else's mistake.

Uninsured Motorist (UM) Coverage: Your Shield When They Have Nothing

Imagine you’re hit by a driver who has no insurance at all—a frighteningly common scenario on Texas roads. In this situation, your Uninsured Motorist (UM) coverage essentially acts as a substitute policy for the at-fault driver. It steps into the shoes of the insurance they were supposed to have and pays for your damages.

Instead of trying to sue a driver who probably has no money to pay a judgment, you file a claim with your own insurance company. Your UM policy is there to cover your very real losses, including:

- Medical Bills: From the ambulance ride and ER visit to surgery, physical therapy, and any future medical care you might need.

- Lost Wages: If your injuries keep you out of work, UM coverage can replace the paychecks you miss.

- Pain and Suffering: This compensates you for the physical pain and emotional trauma the crash and your injuries have put you through.

Without UM coverage, you'd be left to figure out how to pay these devastating costs on your own. It’s a critical shield against a true worst-case scenario.

Underinsured Motorist (UIM) Coverage: Bridging the Gap

Now, let's look at an even more common problem. The driver who hit you has insurance, but it's only the bare minimum required by the state. While Texas law mandates liability insurance, the minimums are shockingly low: $30,000 per person for bodily injury, $60,000 per accident, and $25,000 for property damage. You can discover more about these requirements and how UM/UIM protection is offered on new auto policies.

A serious wreck can easily blow past those low limits in a heartbeat.

Real-World Example: A Houston Freeway Crash

Picture this: you're hurt in a multi-car pileup on I-10. Your medical bills quickly climb to $100,000. The at-fault driver only carries that minimum $30,000 liability policy. Their insurance pays out the full $30,000, but that still leaves you with a $70,000 shortfall just for your medical care—not even touching your lost income or pain and suffering.

This is precisely where Underinsured Motorist (UIM) coverage becomes your hero. It bridges the gap between the at-fault driver's lowball policy limit and the actual cost of your damages.

In this scenario, you could file a claim against your own UIM policy to recover that remaining $70,000 plus compensation for your other losses. For a deeper look into how this works, you might find our guide on underinsured motorist coverage in Texas helpful.

To make the distinction crystal clear, here’s a simple breakdown:

Understanding UM vs UIM Coverage in Texas

| Coverage Type | When It Applies | What It Covers |

|---|---|---|

| Uninsured Motorist (UM) | When the at-fault driver has no insurance, or in a hit-and-run where they can't be found. | Your medical bills, lost wages, and pain and suffering, up to your policy limits. |

| Underinsured Motorist (UIM) | When the at-fault driver has insurance, but their policy limits aren't enough to cover all your damages. | The difference between the at-fault driver's policy limit and the full amount of your damages, up to your UIM limits. |

Both of these coverages are there to protect you from the financial fallout caused by other drivers' irresponsibility.

The "Opt-Out" Rule You Must Know

One of the most critical things to understand about this coverage in Texas is how you get it. The Texas Insurance Code requires insurers to offer you UM/UIM coverage with every new auto policy. In fact, it's automatically included unless you take specific action to refuse it.

To decline this vital protection, you must reject it in writing. A lot of drivers don't know this and may not even realize they have this valuable coverage until they desperately need it. It’s always a good idea to pull out your policy declarations page and confirm you have adequate UM/UIM limits.

Think of this coverage not as an extra cost, but as essential protection for your family's future. After all, you can't control how others drive, but you can absolutely control how well you're protected when they make a mistake.

Your First Steps After a Crash with an Uninsured Driver

The moments after a car crash are chaotic. Your head is spinning, your heart is pounding, and then you find out the other driver has no insurance. It’s a gut punch that adds a whole new layer of stress to an already awful situation. Knowing exactly what to do next can protect your health, your rights, and your ability to recover fair compensation. What you do in those first few hours is critical.

It's completely normal to feel overwhelmed, but having a clear plan can make all the difference. Think of this as a practical checklist to run through, making sure you don't miss any small detail that could become a big problem for your claim down the road.

This is where your own insurance policy becomes your safety net, stepping in to cover you when the at-fault driver can't.

The image above shows it perfectly: when the other driver is uninsured, you turn to your own policy. It acts as a shield, becoming the main source for your financial recovery.

The Immediate Post-Accident Checklist

If you’re physically able, taking these steps will build a strong foundation for your uninsured motorist claim.

-

Secure the Scene and Call 911: Your safety is the priority. If you can, move your car out of traffic and switch on your hazards. Check on everyone involved. Then, call 911 right away to report the accident and get help for anyone who’s hurt. That police report is a vital piece of evidence for any claim, especially when dealing with an uninsured driver.

-

Gather Key Information: Even if they can't show you an insurance card, get as much information as you can. Snap a picture of their driver's license and license plate with your phone. Politely ask for their full name, address, and phone number. If anyone saw what happened, get their contact details—a witness's account can be invaluable.

-

Document Everything: Become your own investigator at the scene. Use your phone to take photos and videos from every angle. Get pictures of the damage to both cars, where they ended up, any skid marks on the pavement, nearby traffic signs, and any visible injuries. You can never have too much photo evidence.

-

Seek Immediate Medical Attention: This is non-negotiable. You might feel fine, but adrenaline is a powerful painkiller that can mask serious injuries like a concussion or internal bleeding. Get checked out at an ER or an urgent care clinic immediately. Going to a doctor right away not only protects your health, but it also creates an official medical record that connects your injuries directly to the crash.

-

Notify Your Own Insurance Company: Call your insurance agent as soon as you can. Let them know the at-fault driver is uninsured and that you need to open a claim under your uninsured motorist coverage in Texas. Give them the basic facts of what happened. Do not guess about who was at fault or how badly you're hurt.

Practical Advice: Critical Mistakes to Avoid After the Crash

Sometimes, what you don’t do is just as important as what you do. Watch out for these common mistakes that can seriously damage your case.

A serious accident is a crisis on every level—physical, emotional, and financial. Protecting yourself means being careful and deliberate, especially when an insurance company gets involved, even your own.

Here are a few things to steer clear of:

- Do Not Accept Cash at the Scene: The uninsured driver might try to offer you cash on the spot to keep the police and insurance companies out of it. This is almost always a bad idea. The amount they offer won't come close to covering the full cost of repairs, let alone your future medical bills.

- Do Not Give a Recorded Statement: Your insurance company will ask you to give a recorded statement. Politely decline until you’ve spoken with an experienced Houston car accident attorney. Insurance adjusters are trained to ask tricky questions that can get you to say something that minimizes your claim. One innocent, out-of-context comment can be used against you.

- Do Not Downplay Your Injuries: When you talk to the police or your insurer, be completely honest about any pain you're feeling. Saying "I'm fine" at the scene can be used later to argue that the accident didn't cause your injuries.

The aftermath of a wreck is a confusing and stressful time, but you don’t have to go through it by yourself. Following these steps will help protect your rights, and speaking with a lawyer will ensure you have a strong advocate fighting for you.

How to File Your UM or UIM Claim and Win

You’ve been in a wreck with an uninsured driver, but you have UM/UIM coverage. For a moment, you might feel a wave of relief. That relief, however, can quickly fade when you realize what comes next.

Filing a claim means you're about to go head-to-head with your own insurance company—the same one you’ve faithfully paid every month for protection. It’s a tough pill to swallow, but their goal is often the same as any other insurer: protect their bottom line by paying out as little as possible.

This can be a real shock. You expect them to be on your side, but instead, you might face skepticism, delays, and frustratingly low offers. They are not your advocate; they are a business. This section will walk you through how to fight back and build a claim that’s too strong for them to deny.

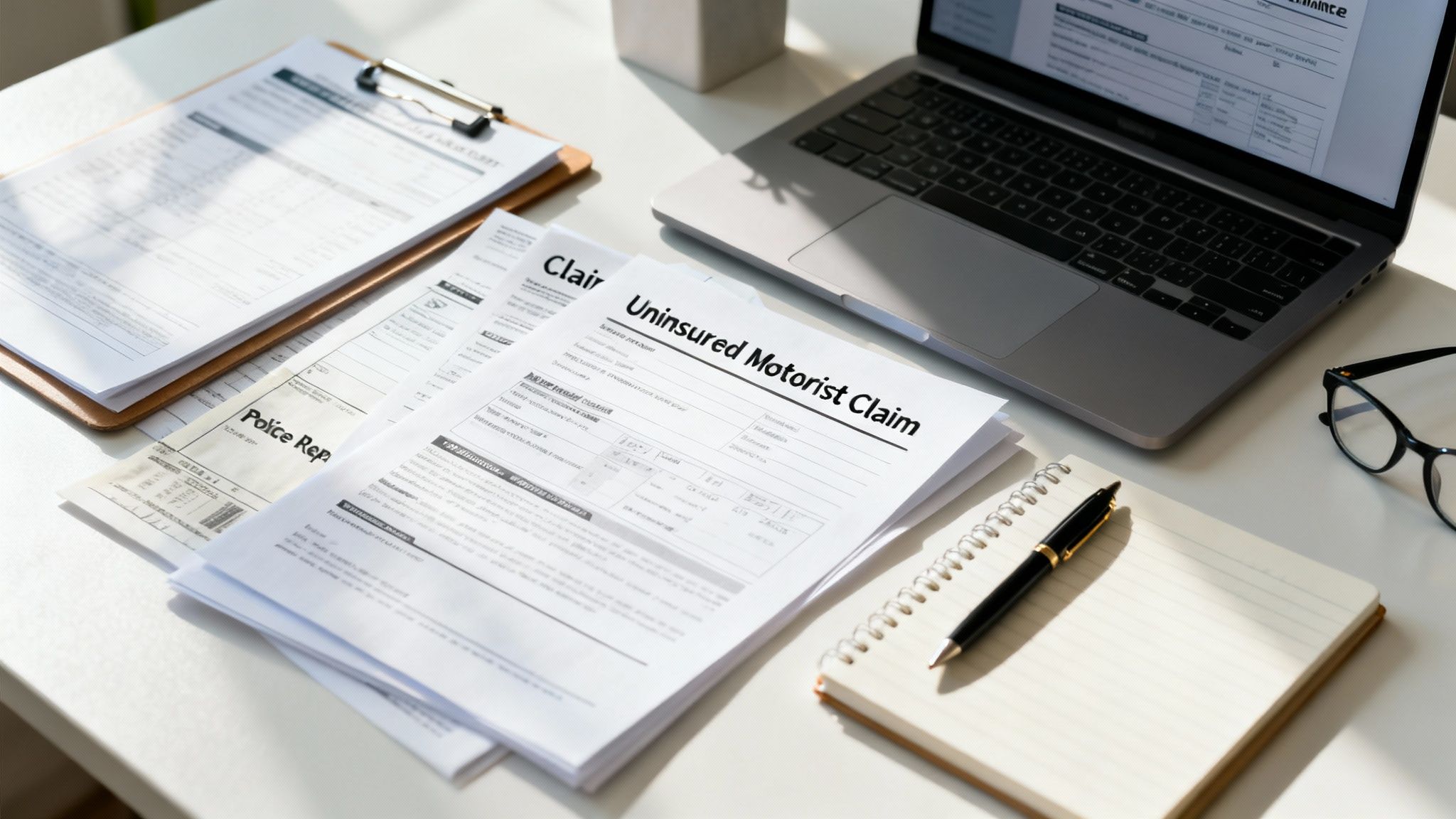

Gathering the Evidence for an Undeniable Claim

Winning a UM or UIM claim boils down to one thing: rock-solid proof. You have to prove not only that the other driver was at fault (negligent) but also show the complete, unvarnished extent of your damages. The more detailed and organized your documentation is, the harder it becomes for an adjuster to find excuses to undervalue your claim.

Your evidence file needs to be airtight. Here are the core documents you will need:

- The Official Police Report: This is the cornerstone of your claim. It identifies everyone involved, gives an official narrative of the crash, and often includes the officer's initial assessment of who was at fault.

- Complete Medical Records: This means everything. From the first ambulance bill and emergency room visit to records of surgeries, physical therapy, prescription costs, and even future treatment plans from your doctors.

- Proof of Lost Income: Collect pay stubs, letters from your employer, and tax documents to create a clear picture of the income you've lost while out of work. If you can’t return to your old job, you'll need evidence showing your diminished earning capacity.

- Photos and Videos: Those pictures you snapped at the scene are invaluable. Just as important are photos showing your injuries as they heal—they can be a powerful way to illustrate your pain and suffering.

For a more in-depth guide on gathering these items, take a look at our post on how to file a car accident claim, which provides even more practical steps.

How to Handle Insurance Company Tactics

Even with a mountain of evidence, you need to be ready for pushback. Insurance adjusters are trained negotiators, and they have a playbook of tactics designed to chip away at the value of your claim. One of their favorite tools involves Texas’s comparative responsibility laws.

Under this rule, also known as the 51% bar, you are barred from recovering any money if you are found to be 51% or more at fault for the accident. Insurers will latch onto any detail—no matter how small—to push some of the blame onto you. They might argue you were speeding, distracted, or didn't brake fast enough, even when the other driver was clearly negligent.

Your own insurance company can start to feel more like an opponent than an ally. They might question whether your medical treatments were truly necessary, hint that your injuries were pre-existing, or flat-out argue that you’re not as hurt as you claim. This is exactly why having a strong legal advocate in your corner is so critical.

Another common move is to offer a quick, lowball settlement. They’re banking on you being stressed, in pain, and desperate enough to take it. But these initial offers almost never cover the true, long-term costs of a serious injury.

Real-World Example: A Multi-Car Freeway Pileup

Imagine you’re caught in a massive pileup on I-69 in Houston. The crash was started by one driver who swerved recklessly across three lanes of traffic. You’re left with serious back injuries, and to make matters worse, the at-fault driver is uninsured.

You file a claim with your own insurer, handing over your medical records and proof of lost wages. The adjuster immediately pivots to comparative fault, claiming that dashcam footage shows you were following the car ahead of you too closely. They argue you are 30% at fault and slash their settlement offer accordingly. Then, they send your medical bills to their "independent" medical examiner, who decides half of your physical therapy sessions were unnecessary.

A skilled Houston car accident attorney or truck crash lawyer Houston sees these moves coming. We would immediately hire an accident reconstruction expert to prove the crash was completely unavoidable due to the at-fault driver's extreme recklessness. We’d also get a detailed report from your own doctor, explaining exactly why every single therapy session was essential to your recovery. By systematically taking apart the insurer’s arguments with stronger evidence, we force them to come to the table and negotiate fairly.

This scenario really drives home why having uninsured motorist coverage in Texas is so critical, especially when you consider the sheer number of drivers without it. It's estimated there are 2.5 to 3 million uninsured drivers on Texas roads at any given time. This coverage isn’t a luxury—it’s an absolute necessity.

Let Us Handle the Insurance Company for You

Trying to recover from a serious accident is stressful enough. The last thing you should have to do is fight an insurance company—especially your own. That’s our job. We take that legal weight off your shoulders so you can put all your energy into what truly matters: getting better.

At The Law Office of Bryan Fagan, PLLC, we have years of experience holding insurance companies accountable for what they owe accident victims across Texas. We’ve seen all the tactics they use to delay, deny, and underpay valid claims, and we know exactly how to fight back.

Your Advocate in a Complex Process

Filing a claim for uninsured motorist coverage in Texas can feel like an uphill battle. Insurance adjusters might downplay your injuries, argue that your medical treatments weren't necessary, or even try to pin some of the blame for the crash on you just to lower their payout.

You need a strong advocate who sees these challenges coming. As your legal team, we will:

- Handle all communications with the insurance company, shielding you from their pressure tactics.

- Build a powerful case file with clear evidence proving the other driver's fault and documenting the true cost of your damages.

- Work with trusted experts, like accident reconstructionists and medical specialists, to validate and strengthen your claim.

- Negotiate aggressively for a settlement that covers everything you’ve lost—medical bills, missed paychecks, and the pain and suffering you’ve endured.

A serious accident can turn your world upside down in an instant. But you don't have to face the legal fight alone. We’re here to provide the clear, steady guidance and powerful advocacy you need to move forward with confidence.

If you were hurt by an uninsured or underinsured driver in a car wreck or a devastating truck accident, you have rights. Don't let an insurance company decide your future. Our team, including our dedicated Houston car accident attorneys and compassionate wrongful death lawyer Texas, is here to stand with you.

We invite you to schedule a free, no-pressure consultation to talk about your situation. Let us show you how we can help you get the justice and financial recovery you deserve.

Uninsured Motorist Claims: Your Questions Answered

After a crash, it's natural to feel overwhelmed and have a million questions running through your mind. It’s a stressful, uncertain time. Below, we’ve tackled some of the most common concerns we hear from clients navigating uninsured motorist claims here in Texas, with clear, straightforward answers.

How Long Do You Have to File a Claim in Texas?

In Texas, the statute of limitations for personal injury claims, including those involving car accidents, is generally two years from the date of the crash. This means you have a two-year window to either settle your claim or file a lawsuit. If you miss this deadline, you will likely lose your right to recover any compensation. While there are some exceptions, it is critical to act quickly to protect your rights.

Can I Still File a UM Claim If I Was Partially at Fault?

Yes, in most cases you can. Texas operates under a modified comparative responsibility rule, often called the 51% bar. This means you can still recover damages as long as you aren’t found to be 51% or more responsible for causing the accident.

However, your final compensation will be reduced by your percentage of fault. For instance, if you have $100,000 in damages but are found 10% at fault, your recovery would be reduced to $90,000. This is where an experienced Texas personal injury lawyer is invaluable—we build a strong case to show the other driver was primarily negligent and protect the full value of your claim.

What if My Own Insurance Company Denies My UM Claim?

It’s a frustrating scenario, but it happens. If your own insurer denies a legitimate UM or UIM claim without a good reason, you might have grounds for a separate legal action for insurance bad faith. Your insurance company has a legal duty to treat you with good faith and fair dealing. A wrongful denial is a direct violation of that duty.

Actions that could signal bad faith include:

- Denying your claim without conducting a proper investigation.

- Causing unreasonable delays in handling your claim.

- Misrepresenting your coverage to get out of paying.

If your claim was denied, don't just accept it. Contact an attorney right away to review the denial letter and figure out your next steps.

Does UM Coverage Apply to a Hit and Run Accident?

Absolutely. In Texas, the law treats a hit-and-run driver the same as an uninsured one. Your UM coverage is designed to step in and cover your damages when the at-fault driver takes off and can't be found.

To successfully bring a hit-and-run claim, you generally need to prove there was actual physical contact between your car and the "phantom" vehicle. It's also critical that you report the accident to the police as soon as possible.

An attorney can help you pull together the evidence needed to build a solid hit-and-run claim and make sure your insurance company honors its obligations.

A serious car accident can turn your world upside down, but you don’t have to fight the legal battle on your own. Recovery is possible, and legal help is available. The dedicated attorneys at The Law Office of Bryan Fagan, PLLC are ready to fight for the full compensation you deserve. Schedule your free, no-obligation consultation today. Let us take on the insurance company so you can focus on what matters most: your recovery.