A serious accident can change your life in seconds—but you don’t have to face it alone. If someone else’s negligence caused your injuries, you are likely feeling overwhelmed, hurt, and unsure of what to do next. The first step toward getting back on your feet is understanding your rights. Here in Texas, if you were injured by someone else, you will most likely file what’s known as a third party claim.

Simply put, this means you are seeking compensation from the at-fault person's insurance company, not your own. This guide will walk you through how it works, what to expect, and how a compassionate Texas personal injury lawyer can help you navigate this process.

Understanding Your Rights After an Accident

When you're trying to heal, legal jargon is the last thing you want to deal with. But the idea of a third-party claim is actually pretty straightforward.

Imagine this: a driver glued to their phone runs a red light and smashes into your car on a Houston freeway. Their insurance company is the "third party" that is responsible for your damages. You have a direct legal right to file a claim against their policy to cover everything you’ve lost due to their driver's carelessness.

This is the opposite of a first party claim, which is when you file with your own insurance company. You’d do that if a hailstorm damages your roof, or if you use your own medical payments coverage right after a wreck, regardless of who was at fault.

The real difference boils down to who caused the harm. Texas personal injury law is built on holding the negligent person accountable. A third-party claim is the legal tool we use to enforce that accountability and get you the financial support you need to recover.

First Party vs. Third Party Insurance Claims

To make it even clearer, here’s a quick comparison to understand who pays for your damages after an accident.

| Claim Type | Who You File With | When It Applies | Example |

|---|---|---|---|

| Third Party Claim | The at-fault party's insurance company. | When another person or entity's negligence causes your injuries. | A truck driver causes a multi-car pileup on I-35; you file a claim with the trucking company's insurer. |

| First Party Claim | Your own insurance company. | When you are using your own policy benefits, regardless of fault. | You use your Personal Injury Protection (PIP) coverage to pay initial medical bills after any car accident. |

This process can feel like a maze, especially when you're just trying to focus on healing. It's also critical to know what to do if the driver who hit you doesn't have enough insurance to cover your bills. You can learn more about underinsured motorist coverage in our article to see how your own policy can offer a vital safety net.

At The Law Office of Bryan Fagan, PLLC, we believe you deserve clarity, not confusion. We’re here to handle all the complexities of your third-party claim so you can focus on the one thing that truly matters—your health and your family.

Proving Fault and Negligence in Your Claim

It’s not enough to simply say someone else caused your accident. To win a third-party claim in Texas, you and your attorney must legally prove the other party was negligent. Negligence isn't just a simple mistake; it's a failure to act with the reasonable care every person owes another. In Texas, proving it is the absolute foundation of your case.

Think of it like building a table. Your claim needs four solid legs to stand on. If even one is missing, the whole thing comes crashing down. Your attorney’s job is to establish every single one of these elements to build a case that can’t be knocked over.

The Four Elements of Negligence

Building a strong third-party claim is all about connecting the dots. We have to draw a clear, undeniable line from the other party's actions directly to the harm you suffered, using solid evidence.

- Duty of Care: First, we have to show the other person owed you a legal duty to be careful. This is usually straightforward. Every single driver on a Texas road has a duty to obey traffic laws and watch out for others.

- Breach of Duty: Next, we prove they broke that duty. This is the specific careless act—the moment they ran a red light, glanced at a text message instead of the road, or drove too fast for conditions.

- Causation: The third step is critical: we have to link their mistake directly to your injuries. We must show that their carelessness was the direct cause of the crash and, in turn, the harm you suffered.

- Damages: Finally, we have to show you suffered real, measurable losses. These are your damages—things like medical bills, lost paychecks, your wrecked car, and the physical pain and emotional trauma you’ve had to live with.

Let’s put it all together with a real-world example. Imagine you’re driving through a Dallas intersection on a green light. Another driver, trying to beat the light, floors it and T-bones your car.

In that scenario, the other driver had a duty to obey the traffic signal. They breached it by speeding through a red light. That breach directly caused the collision that left you with a broken arm and whiplash. The damages are your hospital bills, the weeks of work you missed, and the daily pain you now face. By proving these four points, your attorney establishes the legal fault needed to win your third-party claim.

A huge mistake people make is thinking that just because an accident happened, the other driver is automatically negligent. Texas law doesn't work that way. You have to prove every single one of these four elements to hold the at-fault party accountable.

What Is Comparative Responsibility in Texas?

Texas law understands that accidents aren't always black and white. Sometimes, more than one person shares a piece of the blame. This is where a rule called comparative responsibility (or proportionate responsibility) comes into play, and it can have a massive impact on your case.

Under this system, a judge or jury looks at everyone involved and assigns a percentage of fault to each person. Your final compensation is then reduced by whatever percentage of fault is assigned to you. For example, if you were found 10% responsible for a crash on a Houston freeway and your damages were $100,000, you could recover $90,000.

But here's the catch—and it's a big one. Texas has a "51% bar" rule. This means if you are found to be 51% or more at fault for the wreck, you get nothing. Zero. You are completely barred from recovering any compensation.

Insurance adjusters know this rule inside and out. It’s one of their favorite tools for trying to shift blame onto you, hoping to reduce what they have to pay or deny your claim completely. This is exactly why you need a skilled Texas personal injury lawyer in your corner—we fight back against these unfair blame games and protect your right to a fair recovery.

Your Step-by-Step Guide to the Claims Process

The moments after a crash are a blur. You're dealing with shock, pain, and a whole lot of confusion. Even in that chaos, there's a clear path to holding the at-fault driver accountable. Knowing the steps can give you a sense of control right when you need it most.

Think of it like a roadmap. While every accident journey is a little different, the key milestones are generally the same. A Texas personal injury lawyer will handle the navigation for you, but understanding the route ahead empowers you to make the best decisions for your recovery.

The First Crucial Steps After an Accident

What you do in the immediate aftermath of a wreck can have a massive impact on your health and the strength of your future claim. Your well-being is always, always the top priority.

- Seek Medical Attention Immediately: Even if you feel okay, get checked out by a doctor. Adrenaline is powerful and can easily mask serious injuries like concussions or internal bleeding. If you wait, you not only risk your health but also give the insurance company an easy excuse to argue your injuries weren't caused by the accident.

- Report the Accident: Call 911. Getting police and paramedics to the scene is non-negotiable. The police report they create is a vital piece of evidence because it's an official, impartial account of what happened.

- Gather Information (If Possible): If you're physically able, exchange information with the other driver. You'll want their name, contact info, driver's license number, and insurance details. Also, get the names and phone numbers of anyone who witnessed the crash. Their story can be incredibly powerful later on.

Notifying the Insurer and Building Your Case

Once you're safe and have your immediate medical needs sorted out, the formal claims process kicks off. This is where strategy and documentation become everything.

You’ll need to notify the at-fault driver's insurance company that you intend to file a claim for your injuries and damages. But be careful—this is a critical moment. It's always a smart move to speak with an attorney before you talk to their adjuster.

An experienced lawyer will manage these conversations for you and immediately start the vital work of building your case. This includes:

- Securing the Police Report: We get our hands on the official crash report and break down its findings.

- Interviewing Witnesses: We track down and speak with everyone who saw the accident to lock in detailed statements that back up your side of the story.

- Collecting Medical Records: We gather every piece of paper related to your injuries, treatment, and future outlook to prove the full extent of your suffering.

- Documenting All Your Losses: This covers everything from lost wages and vehicle repair bills to the cost of future medical care. You can find more details in our complete guide on how to file a car accident claim in Texas.

The Demand and Negotiation Phase

After we've collected all the evidence and have a clear picture of your total losses—both what you've already faced and what's to come—we prepare a demand letter. This isn't just a simple note; it's a formal legal document that lays out the facts, proves the other driver's negligence, and demands a specific amount of money to settle your claim.

This is where the real back-and-forth begins. Insurance adjusters are professional negotiators, and their primary job is to protect their company's profits. They will almost never accept the first demand. Instead, they’ll come back with a counteroffer, which is usually way below what you actually deserve.

This negotiation dance can be frustrating, but it's a totally normal part of the process. Our attorneys are skilled fighters who know how to shut down lowball offers, using the mountain of evidence we've built to justify your claim's full value and push for a fair settlement.

A common mistake is trying to handle these negotiations on your own. The adjuster might sound friendly and concerned, but they are not on your side. Saying the wrong thing—like downplaying your pain or admitting even a tiny bit of fault—can torpedo your case.

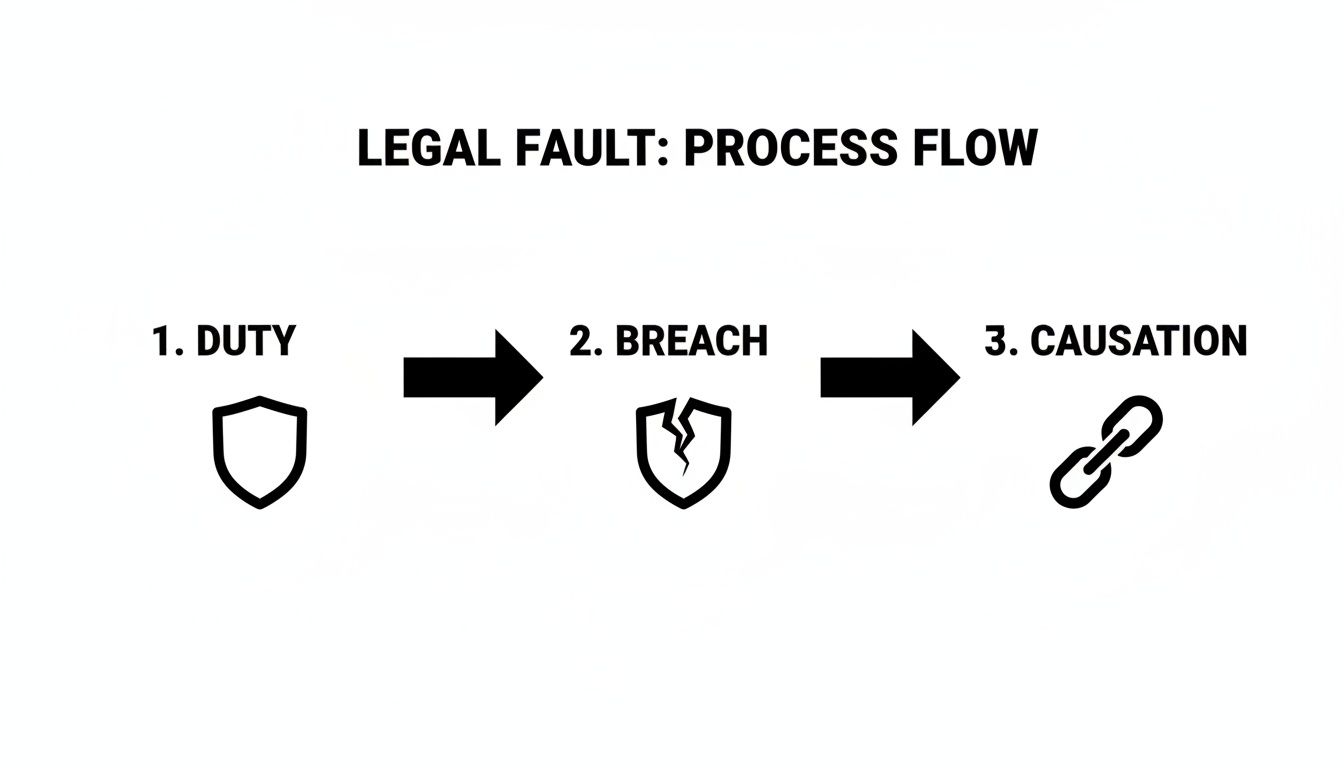

This visual below breaks down the core legal ideas—Duty, Breach, and Causation—that we have to prove to hold the at-fault party responsible.

This process shows how your claim is built on a solid legal foundation, drawing a straight line from the other driver's failure to your injuries. We prepare every single case as if it’s going to trial. If the insurance company refuses to do the right thing and offer a fair settlement, we are always ready to file a lawsuit and fight for you in front of a judge and jury.

Calculating the Full Value of Your Claim

When you're hurt in an accident, your compensation needs to do more than just pay off the first stack of medical bills. A fair settlement must cover every single loss you've suffered—and will suffer in the future—because someone else was careless. In Texas, these losses are legally called "damages," and understanding what they cover is the key to making sure you aren't left with unexpected costs down the road.

Insurance companies love to rush you into a quick, lowball settlement that only covers your immediate expenses. Don't fall for it. An experienced attorney can help you calculate the true, full value of your claim, making sure every past, present, and future need is accounted for.

Economic Damages: The Tangible Costs

The easiest damages to wrap your head around are the ones with a clear price tag. We call these economic damages, and they represent the direct financial hit you've taken because of your injuries. Think of them as the actual receipts and bills you can hold in your hand and add up.

Our job is to meticulously document every one of these costs to build an undeniable case for your financial recovery.

Common examples of economic damages include:

- Medical Bills: This covers everything from the ambulance ride and ER visit to surgeries, hospital stays, physical therapy, and prescriptions.

- Future Medical Care: For serious injuries, recovery is a marathon, not a sprint. We bring in medical experts to project the costs of future treatments, surgeries, or long-term care you’ll need.

- Lost Wages: We calculate every dollar you lost from being unable to work, including missed salary, overtime, bonuses, and benefits you would have earned.

- Loss of Earning Capacity: If a catastrophic injury prevents you from ever returning to your old job—or working at all—we fight for compensation to cover the income you would have earned over your lifetime.

- Property Damage: This includes the cost to repair or replace your vehicle and any other personal items destroyed in the crash.

It's also crucial to include all related medical expenses, like the costs of durable medical equipment that might be necessary for your recovery.

Non-Economic Damages: The Human Cost

Just as important—but much harder to put a number on—are the non-economic damages. These losses don't come with a neat invoice, but they represent the profound human cost of an accident. This is compensation for the ways your life has been turned upside down.

In Texas, you have the right to be compensated for your suffering. These damages acknowledge that an injury is more than a set of medical bills—it's a painful, life-altering event.

Non-economic damages cover the invisible wounds, like:

- Pain and Suffering: The physical pain, discomfort, and agony caused by your injuries.

- Mental Anguish: The emotional trauma, anxiety, depression, and PTSD that often follow a serious wreck.

- Physical Impairment: Compensation for the loss of use of a body part or a physical function.

- Disfigurement: The emotional toll of permanent scarring or changes to your physical appearance.

- Loss of Enjoyment of Life: Your inability to participate in hobbies, activities, or relationships that once brought you joy.

Think about a construction worker who suffers a severe back injury after being hit by a commercial truck on I-10 near Houston. His economic damages are clear: hospital bills and lost wages. But his non-economic damages are the chronic pain that never fades, the depression from being unable to provide for his family, and the heartbreak of no longer being able to play catch with his kids.

Calculating these damages takes skill and experience. A dedicated Houston truck crash lawyer knows how to tell your story and show the full impact the accident has had on every corner of your life. These claims can be substantial; in North America, clients recently recovered over USD 1.4 billion in certain complex claims, which shows just how high the stakes can be. You can discover more findings on modern claims processing on aon.com. We make sure your human losses are never overlooked.

How to Spot and Sidestep Common Insurance Company Tactics

After a crash, you’re in a tough spot. You’re hurt, trying to heal, and probably worried sick about money. The other driver’s insurance company understands this. Their job isn’t to make you whole; it’s to protect their bottom line by paying out as little as humanly possible on your third-party claim.

To do this, their adjusters have a playbook of tactics designed to chip away at your claim’s value, delay payment, or deny it altogether. Knowing these moves is your best defense. An even better one? Having a lawyer handle all the phone calls, so you don’t have to deal with these games at all.

"We Just Need a Quick Recorded Statement"

Almost immediately, an adjuster will call you, sound incredibly friendly, and ask for a recorded statement. They'll tell you it's just a routine part of the process to get things moving. Do not fall for it.

This is a classic trap. Their real goal is to get you on record saying something—anything—they can twist and use against you later. They’ll ask tricky, leading questions designed to get you to second-guess yourself or minimize what happened. Think things like, "So, you're feeling a bit better today?" or "Were you in a hurry right before the crash?"

You are under no legal obligation to give them a recorded statement, and it almost never helps your case. Never agree to one without talking to your attorney first.

The Fast-Cash, Lowball Settlement Offer

Another common tactic is dangling a quick settlement check in front of you, sometimes just a few days after the accident. When bills are starting to pile up, that offer can seem tempting. But it's a cold, calculated strategy. The adjuster is betting you don’t yet grasp the full extent of your injuries or the true cost of your recovery.

Accepting a quick settlement is almost always a huge mistake. Once you sign that release form, you give up your right to ever ask for more money for that accident—even if you find out later you need major surgery or months of physical therapy.

A fair settlement must cover everything, including medical care you might need years from now, not just the bill from the emergency room. A good personal injury lawyer will make sure your claim isn’t settled until your doctors have a clear picture of your long-term prognosis and the true value of your losses is understood.

Questioning Your Doctor's Orders

As time goes on, the insurance company might start questioning your medical care. You’ll hear them argue that a certain procedure wasn’t “medically necessary” or that you're going to the doctor “too often.” It's a tactic designed to bully you and reduce the value of your medical damages.

They might even demand you see a doctor they hired—an "independent" medical examiner—hoping to get a report that downplays your injuries. When they pull these stunts, remember:

- Your doctor knows best. The physician treating you understands your health far better than an insurance adjuster on the phone. Stick to their treatment plan.

- Never miss your appointments. Skipping doctor's visits or physical therapy gives the insurer the perfect excuse to argue you aren't as hurt as you claim.

- Document everything. Keep a simple journal of your pain levels, symptoms, and all the ways your injuries are making daily life harder.

These tactics are meant to exhaust you and make you give up. But you don't have to fight them by yourself. The second you hire The Law Office of Bryan Fagan, PLLC, we take over. We handle every call, email, and letter from the insurance company, shielding you from these strategies and fighting for every penny you deserve.

Why a Texas Personal Injury Lawyer Is Your Best Ally

You should never have to take on a massive insurance corporation by yourself, especially while you're trying to heal from an injury. It is not a fair fight.

Hiring a Texas personal injury lawyer from The Law Office of Bryan Fagan, PLLC, is about leveling that playing field and putting a dedicated advocate in your corner. We step in to shield you from the insurance company's tactics and build a powerful case for the full compensation you deserve.

An insurance adjuster’s job is to save their company money. Our job is the exact opposite. We fight for you and only you.

How We Build a Winning Claim

From the moment you hire us, we get to work. We don’t just file paperwork; we become your investigators, strategists, and staunchest defenders, taking decisive action to protect your rights and strengthen your third-party claim.

Our legal team immediately gets to work by:

- Conducting an Independent Investigation: We don’t just rely on the police report. Our team revisits the accident scene, gathers physical evidence, and works to uncover crucial facts the insurance company might have overlooked or ignored.

- Handling All Communications: We take over every phone call, email, and letter from the insurance adjuster. This means you won’t have to worry about saying the wrong thing or falling into a recorded statement trap designed to weaken your claim.

- Negotiating Forcefully: Armed with solid evidence and a deep knowledge of Texas law, we negotiate aggressively for a settlement that covers all your damages—medical bills, lost income, and the human cost of your pain and suffering.

- Preparing for Trial: While most cases settle out of court, we prepare every single claim as if it’s going to trial. If the insurance company refuses to make a fair offer, a dedicated Houston car accident attorney on our team is always ready to fight for you before a judge and jury.

At The Law Office of Bryan Fagan, PLLC, we handle all personal injury cases—including complex wrongful death claims from a compassionate wrongful death lawyer Texas families trust and severe truck accidents—on a contingency fee basis. This means you pay absolutely no attorney’s fees unless we win your case.

This approach ensures everyone has access to justice, regardless of their financial situation. For more information, you might find it helpful to understand how a retainer works with a lawyer when managing legal fees.

The decision to seek legal help is a big one, and you can learn more about when to hire a personal injury lawyer in our detailed guide. Let us handle the legal battle so you can focus completely on your recovery.

How Long Do You Have to File a Claim in Texas?

When you're recovering from a serious injury, you have enough to worry about without confusing legal deadlines. Here are some of the most common questions we get from clients trying to make sense of the personal injury process in Texas.

In Texas, you generally have a two-year window from the date of the accident to file a lawsuit against the person who hurt you. This deadline is known as the statute of limitations, and it’s a hard stop.

Two years might seem like plenty of time, but it disappears fast when you’re focused on doctor’s appointments and getting back on your feet. It's critical to get a lawyer involved early. Evidence vanishes, witnesses move away, and memories fade. If you miss that two-year deadline, you lose your right to seek compensation forever.

What if the Other Driver Doesn’t Have Enough Insurance?

This is an incredibly common—and stressful—scenario. What happens if the at-fault driver is uninsured, or their insurance policy is too small to cover the full extent of your medical bills and lost wages?

This is exactly why you have Uninsured/Underinsured Motorist (UM/UIM) coverage on your own auto policy. It’s a safety net you pay for. Filing a UM/UIM claim is technically a first-party claim against your own insurer, but it's designed to step in when the other driver can't pay. A skilled attorney will explore every possible source of recovery, including pursuing a UM/UIM claim right alongside your third-party claim.

Should I Give a Statement to the Other Driver’s Insurance?

Absolutely not. You have no legal obligation to give a recorded statement to the at-fault driver’s insurance company, and it will not help your case. Their adjusters are trained professionals whose job is to minimize payouts. They know exactly how to phrase questions to trip you up and get you to say something that damages your claim.

The best thing to do is politely decline and tell them to contact your attorney. Let an experienced Texas personal injury lawyer handle all communications. It’s the single best way to protect your rights and your claim.

At The Law Office of Bryan Fagan, PLLC, we understand that recovery is possible, and legal help is available. We believe you deserve to have a clear-headed, powerful advocate in your corner. If you have more questions or you’re not sure what to do next, we’re here to help. Schedule a free, no-pressure consultation with our team today to get your questions answered and find out how we can fight for you.

You can reach us by calling us or visiting our website at https://texaspersonalinjury.net to schedule your free consultation.