A serious accident can change your life in seconds—but you don’t have to face it alone. After an injury, the last thing you need is a letter from an insurance company telling you your claim is denied. It can feel like a final, devastating blow when you're already struggling to recover.

But that denial letter is not the end of the road. Think of it as the start of the real fight for the compensation you deserve. To have a real shot at appealing a denied insurance claim, you first have to understand why they denied it. Once you know their reasoning, your next move is to gather every piece of evidence you can find that proves them wrong. Then, you put it all together in a formal, written appeal that lays out your case, clear as day.

Understanding Why Your Insurance Claim Was Denied

Receiving a claim denial after a traumatic event like a Houston freeway crash can feel incredibly frustrating and unfair. It’s easy to feel like you've hit a brick wall, but this is a common tactic. An initial denial is often just the insurance company's opening move, not their final word.

Insurance companies deny claims for all sorts of reasons, from a simple clerical error to a complex dispute over who was at fault. Pinpointing the why behind their decision is your first, most critical step in building a strong appeal and protecting your rights.

Common Reasons for Insurance Claim Denials in Texas

Insurance companies are businesses, and their primary goal is to protect their bottom line. They often look for any available reason to minimize a payout or reject a claim completely. To them, you aren't just an injured person; you're a claim number representing a potential financial loss.

As a Texas personal injury lawyer, I've seen countless denial letters. They usually cite one of a handful of common reasons. Here's what you might be up against.

Common Reasons for Insurance Claim Denials in Texas

| Denial Reason | What It Means for You | Your First Step |

|---|---|---|

| Dispute Over Fault | The insurer argues you were mostly to blame. Under Texas comparative responsibility laws, if you are found more than 50% at fault, you cannot recover any compensation. | Gather the police report, witness statements, and photos from the scene to prove the other driver's negligence. |

| Policy Exclusions or Lapse | They claim the specific accident isn't covered by the policy, or that the policy wasn't active at the time. | Request a full copy of the policy and review the declaration page and exclusions. Check payment records for proof of active coverage. |

| Insufficient Medical Evidence | The adjuster is questioning your injuries—saying they're not that serious, aren't from this accident, or that you waited too long for treatment. | Collect all medical records, doctor's notes, bills, and imaging results. A detailed statement from your doctor can be a powerful tool. |

| Filing Errors or Missed Deadlines | A simple mistake on a form, missing information, or not reporting the accident quickly enough led to an automatic denial. | Review your original claim paperwork for any errors. Confirm the date you reported the accident and check policy deadlines. |

It's disheartening, and many people give up after getting that denial letter. But challenging the decision is almost always worth it. While insurance companies deny millions of claims every year, very few people—less than 1%—actually appeal. For those who do, a surprising number succeed in getting the denial overturned. You can find more details on these success rates over at KFF Health News.

Your Next Step Is Your Most Powerful One

That denial letter isn't the final verdict. It’s just the insurance company’s official position, and you have every right to challenge it. An appeal is your chance to set the record straight with solid, undeniable proof.

Dealing with insurance adjusters is a strategic game. They are trained negotiators whose job is to protect the company's money, not to help you. To be better prepared for those conversations, check out our guide on how to deal with insurance adjusters for crucial tips. This guide will walk you through exactly what to do next to build a compelling appeal and fight for the fair compensation you are owed. You have rights, and with the right strategy, you can hold them accountable.

Your First Steps After Getting a Denial Letter

Receiving a formal denial letter can feel like a punch to the gut, especially when you are recovering from a serious accident. It feels deeply unfair, and it’s easy to get overwhelmed. The key is to channel that frustration into calm, strategic action. How you respond right now sets the tone for the entire appeals process.

The first—and most important—piece of advice is this: do not pick up the phone and have an angry conversation with the adjuster. While it’s an understandable impulse, it rarely helps your case and can even be used against you later. Instead, take a deep breath. Treat that denial letter not as a final judgment, but as the starting point for your fight.

Carefully Analyze the Denial Letter

Your denial letter is the most important document you have right now. You need to read it carefully—not just once, but several times. The insurance company is legally required to give you a specific reason for their decision.

Look for key phrases and denial codes. Are they questioning who was at fault in your Dallas-area car accident? Are they claiming a specific medical treatment wasn't "medically necessary"? You have to pinpoint their exact argument because your entire appeal will be focused on dismantling that specific point.

Formally Request Your Claim File and Policy

Next, it's time to gather your own intelligence. You have the right to key documents, and you should formally request them in writing. An email creates a digital paper trail, but a certified letter is even better.

You need to ask for two things:

- A complete copy of your insurance policy: This isn't just the summary page. You need all the declarations, endorsements, and exclusions. You have to see the exact contract language they're using to justify the denial.

- Your entire claim file: This is the goldmine. This file contains every note, report, email, and piece of evidence the adjuster has collected. It gives you a behind-the-scenes look at how they evaluated your case and where the weaknesses in their argument lie.

Getting these documents isn't an aggressive move; it's a fundamental step in leveling the playing field. It ensures you and the insurer are working from the same set of facts.

Stay Organized from Day One

From this moment forward, documentation is everything. Get a dedicated folder—physical or digital—and save every single piece of paper related to your claim. This means the denial letter, all medical bills, copies of your written requests, and detailed notes from every interaction.

How Long Do You Have to File a Claim in Texas?

Time is not on your side after an accident in Texas. While your insurance policy will have its own internal deadline for an appeal (often 180 days), you must be aware of the legal clock that’s ticking in the background.

In Texas, the statute of limitations for filing a personal injury lawsuit is generally two years from the date of the accident. This deadline is absolute. If you miss it, you lose your right to seek compensation in court forever. This is why you cannot let the insurance company drag out the appeals process. For example, if a loved one was lost in a wrongful death incident, that two-year clock is a critical boundary for your family’s pursuit of justice. A wrongful death lawyer in Texas can help ensure you meet this crucial deadline.

Your immediate actions after receiving a denial are all about taking back control. You're shifting from being a passive victim to an active participant in your own recovery. By meticulously analyzing their reasoning, gathering your own documents, and respecting the legal timelines, you’re building the foundation for a powerful and effective appeal.

Building a Bulletproof Case for Your Appeal

A successful appeal isn't won with emotion—it’s won with cold, hard evidence. Your mission is to systematically gather the proof that dismantles the insurance company's argument, piece by piece.

Think of yourself as an investigator building a case from the ground up. Every document, photo, and statement tells the true story of what happened. You need to create a compelling narrative backed by undeniable facts, showing the adjuster exactly why their initial decision was wrong.

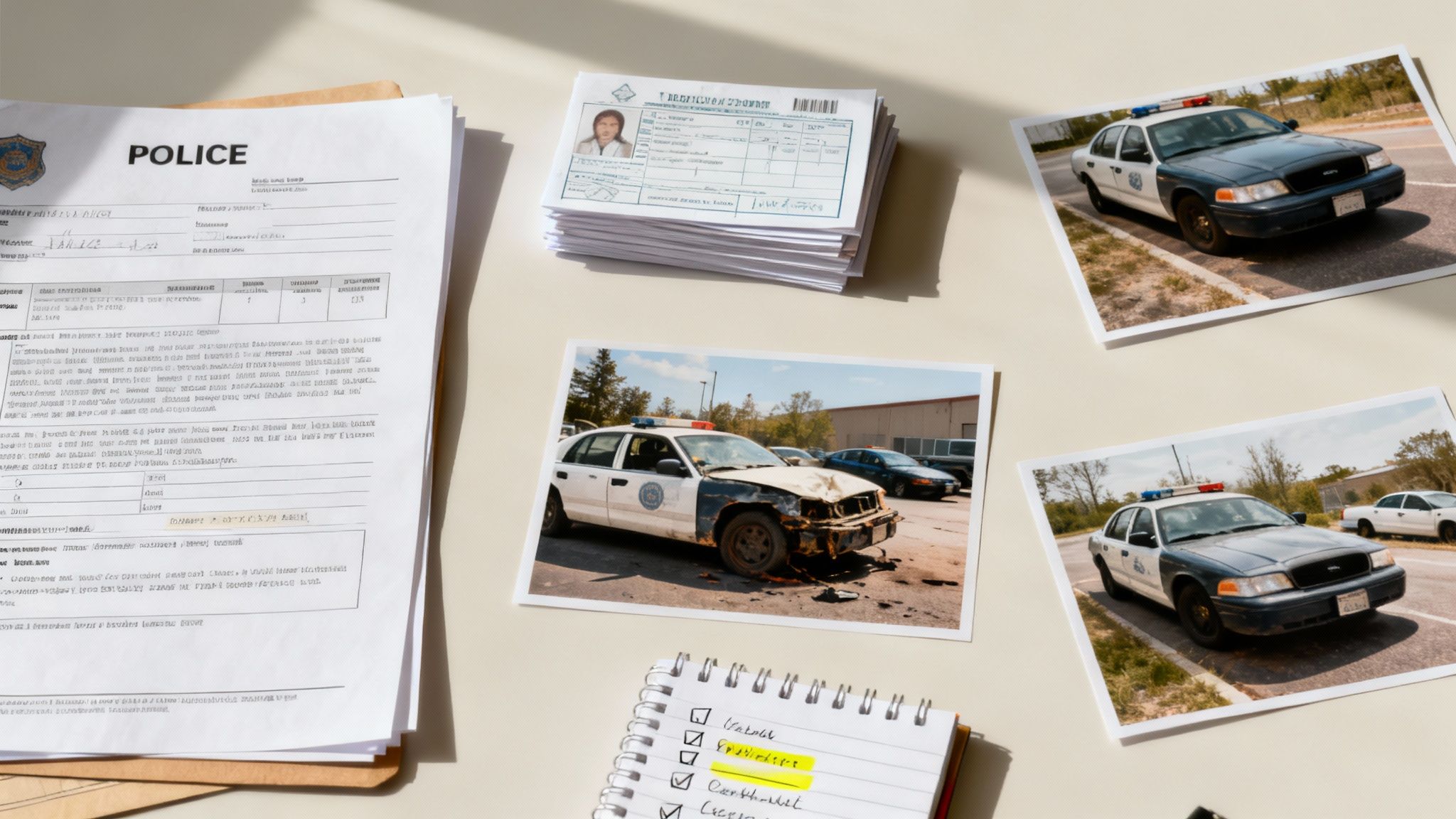

Your Essential Evidence Checklist

Your goal is simple: collect every piece of documentation that covers the accident, the full extent of your injuries, and the financial chaos it's caused in your life. A messy pile of papers won't cut it. You need a well-organized file that logically tears down the insurer’s reasons for denial.

Here’s a checklist of the core documents you’ll need:

- The Official Police Report: This is often the single most important piece of evidence. It contains the responding officer's initial assessment of fault, a diagram of the scene, and contact information for any witnesses.

- Photos and Videos: Visual proof is incredibly powerful. Gather every photo and video from the scene—damage to all vehicles, skid marks, road conditions, and any visible injuries.

- Witness Statements: An independent eyewitness can offer an unbiased account that backs up your version of events. Reach out to anyone listed on the police report and ask them for a brief, written statement of what they saw.

- Your Complete Medical File: This is far more than just the ER bill. You need every single record related to the injuries from your accident.

The Power of Medical Documentation

Adjusters love to deny claims by questioning injuries. They’ll argue your pain was from a pre-existing condition or that you weren't hurt as badly as you claim. This is where your medical evidence becomes your strongest weapon.

A "narrative report" from your treating physician is a game-changer. This is a detailed letter where your doctor explains, in their expert medical opinion, how the crash directly caused your specific injuries, what your future treatment looks like, and how it all impacts your ability to work and live your life. This is especially vital in catastrophic injury cases.

When gathering your sensitive medical records, it's vital to follow privacy protocols by ensuring HIPAA compliance when faxing sensitive documents to protect your private health information.

Connecting Your Evidence to Texas Law

Once you have your evidence organized, the last step is to weave it into a story that proves the other driver’s negligence. In Texas personal injury law, this means you must show they had a duty to drive safely, they breached that duty, and their breach directly caused your injuries and financial damages.

For instance, after a Houston freeway crash, the police report showing the other driver ran a red light establishes they breached their duty of care. Your medical records then connect that breach directly to your injuries. Finally, your repair estimates and lost pay stubs prove the financial damages that resulted.

This process also includes documenting your non-economic damages, which are just as real. Knowing how to prove pain and suffering is a critical part of making sure you demand the full compensation you’re owed. By building a thorough case file, you’re putting yourself in the best possible position to win your appeal.

Writing a Powerful and Persuasive Appeal Letter

Your appeal letter is your chance to formally push back, and it's the most important document you'll create in this fight. This isn't about venting or pleading; it's a strategic, fact-based argument designed to methodically take apart the insurance company's reason for denying your claim.

Think of it as setting the record straight. You're telling the true, complete story of your accident and recovery, backing it up with hard proof every step of the way. Your goal is to construct an argument so clear and well-supported that the adjuster has to reconsider their original decision.

The Anatomy of an Effective Appeal Letter

A strong appeal letter guides the adjuster from point A to point B—from the basic facts of the claim to the unavoidable conclusion that they got it wrong. The structure is key. A jumbled, emotional letter is easy to dismiss, but a professional, organized one demands attention.

Your tone should be firm and assertive, not angry. You are not asking for a favor; you are demanding the coverage you are owed.

Here’s how to build a letter that gets results:

- Header and Claim Info: Get straight to the point. Start with your full name, address, and date of birth. Most importantly, put your claim number front and center.

- A No-Nonsense Opening: State your purpose immediately. "I am writing to formally appeal the denial of my claim [Your Claim Number], concerning the car accident on [Date of Accident]."

- The Accident in a Nutshell: Briefly and factually describe what happened. For example, "On March 15th, I was driving westbound on the Katy Freeway in Houston when a commercial truck failed to yield and struck my vehicle." A truck crash lawyer in Houston would emphasize the specific duties of commercial drivers.

- Confront the Denial Head-On: This is where you dismantle their argument. Quote their exact reason for the denial and immediately counter it with your evidence. For example: "Your denial letter states the claim was denied due to a 'dispute over fault.' This is incorrect. The enclosed police report, marked as Exhibit A, clearly assigns 100% of the fault to the other driver."

Pro Tip: Use Exhibits to Your Advantage

Don't just throw a stack of papers in an envelope. Organize your evidence. Label each document (Exhibit A: Police Report, Exhibit B: Medical Records from Dr. Jones, etc.) and refer to it by name in your letter. This shows you're serious and makes it incredibly easy for the adjuster to follow your logic.

Crafting Your Appeal Letter

To make sure your appeal is as strong as possible, it needs to be comprehensive and professional. Following this table will help you present a clear, persuasive case that is difficult for the insurer to dismiss.

| Essential Components of Your Appeal Letter |

| :— | :— | :— |

| Component | Purpose | Key Tip |

| Claim Information | To immediately identify your case file. | Include your full name, claim number, and date of the accident right at the top. |

| Clear Statement of Appeal | To state the letter's purpose without ambiguity. | Use direct language: "This letter is my formal appeal of your denial dated [Date of Denial Letter]." |

| Factual Summary of Events | To provide context and correct any inaccuracies. | Briefly recount the accident, your injuries, and the treatment you received. Stick to the facts. |

| Direct Rebuttal of Denial Reason | To systematically dismantle the insurer's argument. | Quote their exact reason for denial and then introduce the specific evidence that proves them wrong. |

| Reference to Evidence | To back up every claim with concrete proof. | Refer to your organized exhibits (e.g., "See Exhibit C: Invoices for physical therapy"). |

| Specific Demand for Payment | To state exactly what you expect as an outcome. | Clearly state the total amount you are demanding for medical bills, lost wages, and other damages. |

| Professional Closing | To end on a firm and assertive note. | Conclude by stating you expect a prompt reversal of the denial and full payment. |

By meticulously including each of these elements, you transform your letter from a simple complaint into a powerful legal document that sets the stage for a successful appeal or, if necessary, future legal action.

Finalizing and Sending Your Letter

Once you have a draft, read it over. Better yet, have a trusted friend or family member review it for clarity and tone. You want to come across as confident and organized, not scattered or emotional.

This next step is non-negotiable: Send your appeal letter and all the attachments via Certified Mail with a return receipt requested. This service provides you with a legal receipt proving the insurance company received your appeal and the exact date it arrived. That little green card is your proof, and it officially starts the clock on their deadline to respond. Don't skip this step—it's your protection against them claiming they "never got it."

When Your Internal Appeal Is Not Enough

You’ve done everything right. You gathered your evidence, wrote a powerful letter, and sent it via certified mail. Then, another letter arrives from the insurance company, doubling down on its denial. It’s a frustrating moment, but this is absolutely not the end of your fight.

When an insurer refuses to reconsider a valid claim, you have powerful options that go far beyond their internal process. This is the point where the battleground shifts. You’re no longer just trying to persuade an adjuster; you’re preparing to hold an insurance company accountable under Texas law.

Filing a Complaint with the Texas Department of Insurance

If you believe the insurer is not treating you fairly, you can file a formal complaint with the Texas Department of Insurance (TDI). The TDI is the state agency responsible for regulating the insurance industry and protecting consumers like you. Filing a complaint is free and can be done on their website.

Once you submit your complaint, the TDI will:

- Formally notify the insurance company of your grievance.

- Require the insurer to provide a detailed, written response.

- Review the entire case to see if the company violated any Texas insurance laws.

The TDI can't force an insurer to pay your claim, but a formal complaint creates an official record and puts real pressure on the insurer to justify its actions to a government regulator. This is often enough to make them reconsider their position.

This flowchart shows the basic logic for building a strong appeal letter—it all comes down to professionalism and solid evidence.

Without that foundation of professionalism and hard facts, an appeal simply won't get very far.

Understanding Insurance Bad Faith in Texas

Sometimes, a claim denial isn't just a disagreement over facts—it’s a clear sign of insurance bad faith. Under the Texas Insurance Code, you have a right to be treated fairly and honestly by your insurer. Bad faith happens when an insurance company denies, delays, or underpays your claim without any reasonable basis.

For example, imagine a loved one was killed in a truck crash near Dallas. The evidence overwhelmingly shows the truck driver was at fault, yet the insurance company denies the wrongful death claim without offering a logical reason. This is a classic example of potential bad faith.

Red Flags of Insurance Bad Faith

An insurer might be acting in bad faith if they: refuse to give you a reason for the denial, misrepresent the facts or your policy, use unreasonable delays to frustrate you, or fail to conduct a proper investigation into your claim.

If an insurer acts in bad faith, you may have the right to sue them—not just for the original benefits you were owed, but also for additional damages caused by their dishonest conduct.

When to Call a Texas Personal Injury Lawyer

If your internal appeal has been denied, that's the clearest sign that it’s time to bring in a legal professional. The moment an insurer rejects a well-supported appeal for a serious car accident or catastrophic injury claim, they are essentially daring you to take the next step.

An experienced Texas personal injury lawyer completely levels the playing field. For a deeper look into this crucial decision, explore our guide on when to hire a personal injury lawyer.

Our team can immediately take over all communication, analyze your case for signs of bad faith, and file a lawsuit if the insurer refuses to make a fair settlement offer. A free consultation is your chance to have a Houston car accident attorney review your denial letter and explain your full range of legal options. You don't have to accept an unfair denial as the final word.

Common Questions About the Insurance Appeal Process

After the shock of an accident, navigating an insurance appeal can feel overwhelming. You're likely dealing with a lot of uncertainty and just want straightforward answers. Below are some of the most common questions we hear from families across Texas to give you the clarity you need to move forward.

How Long Do I Have to File an Appeal in Texas?

This is a critical question because there are two different clocks ticking.

First, you have the internal appeal deadline set by the insurance company, which you can find in your denial letter. This is often around 180 days.

The second, and most important, deadline is the Texas statute of limitations. For most personal injury cases, you have just two years from the date of the accident to file a lawsuit. If you miss this deadline, your right to take the case to court is gone forever. Acting quickly is essential to protect all your legal options.

What if the Insurance Company Just Ignores My Appeal?

Legally, they can't. Texas law requires insurance companies to acknowledge your appeal and give you a decision within a set timeframe, usually between 30 to 60 days.

If they go silent, drag their feet, or use other stall tactics, they might be crossing the line into bad faith insurance practices.

Their silence is a response. It’s a clear signal they aren't willing to play fair. This is a massive red flag, and it's the point where you should immediately call an experienced Texas personal injury lawyer to protect your rights.

Can I Handle This Appeal Myself Without a Lawyer?

For a very minor accident with only property damage, you might be able to handle the appeal on your own. But for any claim that involves physical injuries, going it alone is a significant risk.

The insurance company has a team of adjusters and lawyers whose entire job is to protect their profits. You deserve to have a professional in your corner, too.

Hiring an attorney is essential in situations like:

- Serious injuries requiring future medical care.

- Complex fault disputes, like a multi-car pileup on I-10 or a crash involving a commercial truck.

- Bad faith denials, where the insurer is clearly avoiding a legitimate payout.

- Any wrongful death claim where a family is grieving the loss of a loved one.

A good lawyer does more than file paperwork. They level the playing field, handle all stressful communications, and build a case that's ready for trial if the insurer refuses to be reasonable. That's what gets results.

Does Appealing a Denial Cost Anything?

Filing the internal appeal with the insurance company is free. You may have minor costs for gathering evidence, like fees for a police report or medical records, but the appeal itself costs nothing.

If you decide you need legal help, the good news is that personal injury attorneys like us work on a contingency fee basis. This means you pay absolutely no upfront costs or attorney fees. We only get paid if we win your case and recover money for you. This removes the financial risk and allows you to get the expert legal help you need, right when you need it most.

A denied claim is not the end of the road. It’s a roadblock you can overcome. At The Law Office of Bryan Fagan, PLLC, we help accident victims across Texas stand up to insurance companies and fight for the full compensation they are owed. We want you to know that recovery is possible, and legal help is available. You don't have to take on this battle alone. Schedule your free, no-obligation consultation today by visiting texaspersonalinjury.net and learn how we can help you get the justice you deserve.