A serious accident can change your life in seconds — but you don’t have to face it alone. When another driver’s negligence leaves you injured, you should not be stuck with the mountain of medical debt that follows. But while the at-fault driver is ultimately responsible for the costs, getting them to pay isn't instant. The process can feel tangled and confusing, often requiring your own insurance policies to step in first so you can get the care you need right away.

The Critical Question After a Texas Car Accident

A serious car wreck can flip your world upside down in a matter of seconds. Your first priority is, and should be, your health. But as the initial shock fades, a wave of financial anxiety can feel just as overwhelming as your physical pain.

Bills from the emergency room, surgeons, specialists, and physical therapists start flooding your mailbox. That stack of paper represents a massive financial burden, creating incredible stress for you and your family right when you should be focused on healing. At The Law Office of Bryan Fagan, PLLC, we understand this isn't just a legal issue; it's a personal crisis affecting your well-being and your future.

You're probably asking, "Who is supposed to pay for all these medical bills?" It’s the most important question on your mind, and finding the answer is the first step toward taking back control of your life. We're here to give you a clear roadmap for your recovery, starting right now.

A Roadmap for Financial Recovery

Think of the payment process as a line of dominoes. The first ones to fall are often your own insurance coverages. Policies like Personal Injury Protection (PIP) or even your personal health insurance can step up to cover immediate treatment costs. This is crucial—it ensures your care doesn't get delayed while everyone argues over who was at fault.

But that's just the beginning. The final goal is to make the at-fault driver and their insurance company pay for the harm they caused. Under Texas law, their liability policy is on the hook for all your damages. That includes repaying your own insurance policies for the upfront costs they covered, plus compensating you for everything else. A skilled Houston car accident attorney will quarterback this entire process, making sure every single bill is accounted for and paid by the right party.

To help you see how the pieces fit together, let's break down the potential sources for paying your medical bills and when each one usually gets involved.

Potential Sources for Paying Your Medical Bills

This table outlines the different parties and insurance policies that can help cover your medical treatment after a Texas car accident and their typical roles.

| Potential Payer | What It Covers | When It Typically Pays |

|---|---|---|

| Personal Injury Protection (PIP) | Your initial medical bills, some lost wages, and related expenses, regardless of fault. | Immediately after the accident. |

| Your Health Insurance | Medical treatment costs after PIP is exhausted, subject to deductibles and co-pays. | After PIP coverage is used. |

| At-Fault Driver's Liability Insurance | All accident-related damages, including medical bills, lost income, and pain and suffering. | After fault is established, through a final settlement or verdict. |

| Uninsured/Underinsured Motorist (UM/UIM) | Your medical bills and other damages if the at-fault driver has no insurance or not enough. | After it's clear the at-fault driver cannot pay. |

Navigating this process can be tough, but you are not alone in this fight. Recovery is possible. Our team is here to help you secure the resources you need to heal without being crushed by the weight of financial ruin.

When you're trying to heal, the last thing you want to see is a stack of medical bills piling up. But the reality is, those bills don't wait for your personal injury claim to settle. They start showing up almost right away, adding a ton of financial stress when you're already overwhelmed. Figuring out who pays for everything in the short term is key to your peace of mind and making sure you can keep getting the care you need.

The good news is you have a few first lines of defense to handle these initial costs. These options are designed to get your bills paid now, without you having to dip into your own pocket, while your attorney gets to work holding the at-fault driver accountable.

Personal Injury Protection (PIP): Your No-Fault Safety Net

In Texas, your own auto insurance policy comes with a powerful tool called Personal Injury Protection, or PIP. It's a type of "no-fault" coverage, which is just a simple way of saying you can use it to pay your medical bills immediately, no matter who was to blame for the crash. Think of it as your financial first-aid kit.

All Texas auto policies have to offer PIP, though you can technically reject it in writing. We can't stress this enough: don't do it. For a small addition to your premium, PIP provides a critical safety net when you need it most.

Imagine you're in a serious multi-car pileup on a Houston freeway. Your first worry is getting to the hospital. PIP is what can pay for that ambulance ride and the emergency room bills right away, keeping them off your credit report while the insurance companies are still trying to figure out who hit whom.

This coverage is incredibly valuable because it moves fast. You can use it for:

- Emergency medical services and hospital stays.

- Follow-up visits with your doctor or specialists.

- Physical therapy and other rehabilitation costs.

- A portion of your lost wages if the accident has you out of work.

Using your PIP doesn't stop you from going after the at-fault driver. It just gives you immediate breathing room so you can focus on what's most important—getting better.

Medical Payments (MedPay) Coverage

Another option you might have on your policy is Medical Payments coverage, usually called MedPay. Just like PIP, MedPay is a no-fault coverage that pays for your necessary and reasonable medical bills from a car wreck.

But there's one huge difference. MedPay only covers medical expenses. Unlike PIP, it does not cover lost wages. While both are definitely helpful, PIP gives Texas drivers a much broader layer of protection. If you have MedPay, it's just one more immediate resource to use.

Your Personal Health Insurance

After a crash, your own health insurance is another vital resource for getting your bills paid. Once you've used up your PIP or MedPay benefits, your health insurance can kick in to cover your treatment costs, according to your plan's specific deductibles and co-pays.

For instance, if you end up needing surgery and months of physical therapy, your health insurance can be the main payer for those ongoing services. This is what keeps you from racking up massive debt directly with hospitals and doctors. It's crucial to give your health insurance card to every medical provider you see. To get a better handle on this, you can learn more about how health insurance covers auto accidents in our detailed guide.

Now, there’s a critical term you need to know when you use your health insurance: subrogation. It sounds complicated, but it just means your health insurer has a right to get paid back for your medical care out of any settlement you receive from the at-fault driver. A good Texas personal injury lawyer will handle this for you. They will often negotiate with the health insurance company to reduce the amount they demand back, which means more of the final settlement money stays in your pocket, right where it belongs.

How Texas Law Determines Financial Responsibility

While your own insurance policies are a fantastic first line of defense, the ultimate goal is to hold the at-fault driver financially responsible for the chaos they've caused. Texas law operates on a simple, powerful principle: if someone's carelessness hurts you, they are legally required to pay for the consequences. This is the legal bridge connecting your injuries to the person whose actions turned your world upside down.

It all starts with Texas’s “at-fault” system. This just means the person who caused the wreck is on the hook for the damages of everyone they injured. Legally, this responsibility is built on the concept of negligence.

The Principle of Negligence in Texas

Every single driver on a Texas road has a legal "duty of care" to drive safely and avoid hurting others. When a driver violates that duty—by speeding, texting behind the wheel, or blowing through a red light—and causes a crash that injures you, they have been negligent. It’s that simple.

Think of it this way: you're driving through a busy Austin intersection when another driver, glued to their phone, plows through a red light and T-bones your car. Their failure to simply pay attention was a direct violation of their duty to drive safely. Under Texas law, their negligence makes them legally liable for your damages. That includes every dollar of your medical bills, the income you lost while out of work, and the very real physical pain and emotional trauma you’ve suffered.

Holding them accountable through their liability insurance is the primary path to making you whole again.

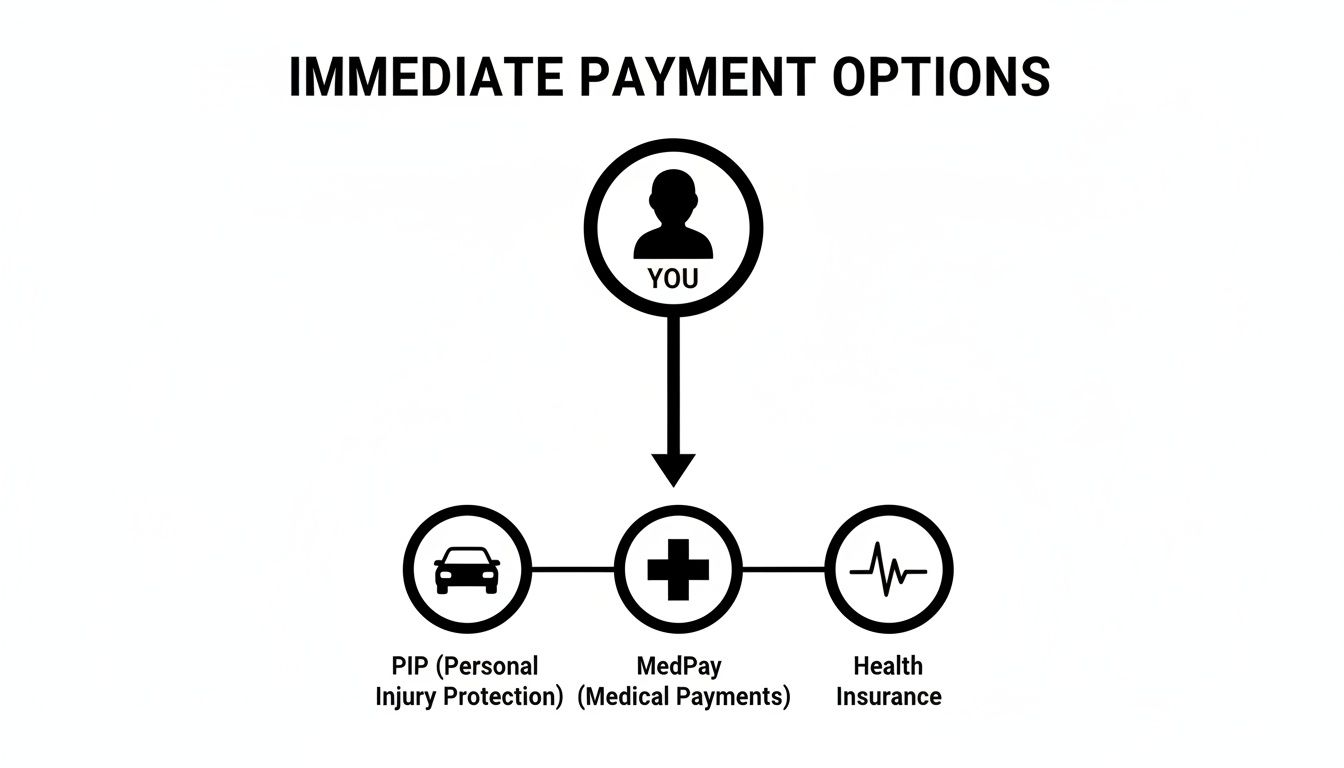

This graphic shows the immediate payment sources available to you while your attorney builds the case against the at-fault driver.

As you can see, your own PIP, MedPay, and health insurance are designed to cover immediate costs so you can get the care you need without delay.

What if You Are Partially at Fault?

Real-world crashes aren't always black and white. It’s a common tactic for the other driver's insurance company to argue that you shared some of the blame for the collision. When this happens, Texas applies a rule called modified comparative fault, sometimes called the “51% Bar.”

This rule might sound complicated, but the core idea is pretty straightforward. A jury will assign a percentage of fault to everyone involved in the crash. As long as you are found to be 50% or less at fault, you can still recover damages from the other driver.

However, your final compensation award will be reduced by your percentage of fault.

- Example: If you have $100,000 in damages but a jury finds you 20% at fault, you can recover 80% of your damages, which comes out to $80,000.

- The 51% Bar: But if you are found to be 51% or more at fault, you are legally barred from recovering a single penny. You get nothing.

Insurance adjusters are masters at shifting blame. They are trained to get you on a recorded line and coax you into saying something—anything—that suggests you were even a little bit responsible. This is exactly why having an experienced Houston car accident attorney handle all communications is absolutely critical to protecting your right to a full and fair recovery.

A skilled lawyer knows these tactics and will fight back against unfair blame-shifting. At The Law Office of Bryan Fagan, PLLC, our entire job is to build a powerful case that proves the other driver’s negligence. We gather the evidence, track down witnesses, and present the facts in a way that leaves no doubt about who was truly responsible. You don’t have to face this complicated legal fight alone.

The True Financial Cost of a Car Accident Injury

When you’re reeling from a serious crash, the last thing on your mind is the long-term cost. You're just trying to get through the day. But to really grasp why a personal injury claim is so critical, you have to look at the real numbers behind a severe injury. These aren’t just figures on a page; they represent a crushing financial weight that can derail a Texas family's future.

A single trip to the emergency room can quickly spiral into a mountain of debt. In fact, the average ER visit after a car accident in Texas rings in at around $3,300. For injuries serious enough to land you in the hospital, that cost explodes to an average of $57,000 over the course of treatment.

And believe it or not, these initial bills are often just the tip of the iceberg. The total medical expenses for people hurt in crashes across the country can hit a staggering $18 billion for lifetime care, according to one study. You can read more about these car accident medical costs to see the full scope of the financial storm you might be facing.

Beyond the Emergency Room

The true financial hit from a serious injury goes far beyond that first hospital bill. Your recovery is a journey, and that journey can involve a complicated—and expensive—web of ongoing medical care.

A severe back or neck injury from a wreck on a Dallas-Fort Worth highway might not just mean one surgery. It can lead to years of pain management, specialist appointments, and extensive physical therapy, with costs piling up every single month.

The total financial picture often includes:

- Multiple Surgeries: Operations to fix broken bones, repair internal damage, or address spinal injuries can cost tens of thousands of dollars each.

- Specialist Consultations: Seeing neurologists, orthopedic surgeons, or pain management doctors adds thousands more to the tab.

- Rehabilitation: Long-term physical and occupational therapy is essential for getting your life back, but it's also a major ongoing expense.

Beyond the immediate crisis, the true financial cost can include long-term therapies and specialized treatments like spinal decompression therapy for chronic back pain. Every one of these necessary treatments adds another layer to the financial burden on you and your family.

Protecting Your Financial Future

These numbers can feel overwhelming, but they perfectly illustrate why you need an advocate in your corner. The at-fault driver’s insurance company knows this game well. They’ll often swoop in with a quick, lowball settlement that might cover your ER visit but leaves you to foot the bill for all those massive long-term costs on your own.

A dedicated Texas personal injury lawyer understands their playbook. Our job is to build a comprehensive case that accounts for every single dollar of your past, present, and future medical needs. We fight to make sure the compensation you get is enough to cover your entire recovery journey, so you aren’t left paying for someone else’s mistake. You deserve to heal without the crushing weight of medical debt, and we're here to make that happen.

When the At-Fault Driver Has No Insurance (Or Not Enough)

It’s one of the most stressful situations imaginable after a crash: you find out the driver who hit you either has zero insurance or carries a policy so cheap it won't even scratch the surface of your medical bills. This happens all the time in Texas, leaving good people feeling stuck and wondering how they'll ever recover financially.

This is precisely where your own Uninsured/Underinsured Motorist (UM/UIM) coverage comes into play. Think of it as a critical safety net woven into your own auto policy, designed to protect you and your passengers when the person who caused the wreck can't pay.

You don't buy UM/UIM to protect the other driver; you buy it to protect yourself. It's a promise you make to your family that, no matter who hits you, there will be a path to financial recovery.

The Two Shields of Protection

While UM and UIM are often sold as a package deal, they tackle two very different—and equally frustrating—scenarios. Knowing how each one works gives you a clear picture of your options.

- Uninsured Motorist (UM) Coverage: This is your go-to when the at-fault driver has no liability insurance at all. It's also the coverage that applies in a devastating hit-and-run, where the driver disappears and can't be found.

- Underinsured Motorist (UIM) Coverage: This kicks in when the at-fault driver does have insurance, but their policy limits are too low to cover the true cost of your damages—all your medical treatments, lost time from work, and pain and suffering combined.

Imagine getting seriously hurt by a hit-and-run driver on a busy Dallas freeway. Since there's no one to make a claim against, your own UM policy steps into that empty space. It becomes the source of compensation, ensuring one person's reckless act doesn't upend your entire life.

How Underinsured Motorist Coverage Really Works

Let's walk through a real-world example of how UIM can be an absolute financial lifesaver.

Say your total damages—medical bills, lost income, and everything else—add up to $100,000. The driver who hit you only has the Texas state minimum liability coverage of $30,000.

Without UIM, you'd get the $30,000 from their insurance and be left holding the bag for the other $70,000.

But with UIM coverage, you can turn around and file a claim against your own insurance company for that remaining $70,000. Your policy bridges the gap left by the underinsured driver, making it possible for you to be made whole. This is exactly why carrying as much UIM coverage as you can comfortably afford is one of the smartest financial decisions a driver can make.

Why You Still Need a Lawyer for a UM/UIM Claim

Here’s the catch: even though you’re filing a claim with your own insurance company, it's not always a friendly process. Insurance is a business, and your provider may still try to downplay your injuries or argue about the value of your claim to protect their bottom line. This is where having a skilled attorney becomes so important.

An experienced lawyer manages the whole UM/UIM process for you. We prove the other driver was uninsured or underinsured, meticulously document the full value of your damages, and handle all the tough negotiations. We fight to make sure your insurance company honors the very policy you've paid for faithfully, month after month.

To get a deeper look into this complex situation, check out our guide on what happens if someone hits you without insurance. You have powerful options, and we're here to help you use them.

How a Lawyer Manages Your Medical Bills and Recovery

After a serious wreck, the flood of medical bills can feel like a second crisis hitting you all at once. This is where a dedicated lawyer does more than just file paperwork. We step in to manage the entire financial side of your recovery, turning a chaotic and stressful mess into a clear, strategic process.

Our main goal is to make sure you get the best medical care possible without the crushing weight of upfront costs. Your only job should be focusing on healing.

One of the most powerful tools we use is a Letter of Protection (LOP). Think of it as a formal promise we send to your doctors, surgeons, and physical therapists. This legally binding document guarantees their bills will be paid directly out of any future settlement or jury award we win for you.

An LOP is a game-changer. It allows you to get the medical treatment you need—even complex surgeries or long-term therapy—with zero out-of-pocket costs. It puts a stop to the fear of mounting debt and ensures your care is never delayed just because of money.

Shielding You from Insurance Adjusters

The moment you file a claim, the at-fault driver's insurance adjuster will start calling. Their job isn’t to help you; it’s to protect their company’s profits by minimizing your claim or denying it outright.

These adjusters are trained to get you on a recorded line, hoping to twist your words to pin blame on you or downplay how badly you were hurt.

When you hire The Law Office of Bryan Fagan, PLLC, those calls stop. Immediately. We take over all communications with the insurance companies.

Your attorney becomes your dedicated shield and spokesperson. We handle every single phone call, email, and negotiation, making sure your rights are protected at every turn. You no longer have to deal with the stress and pressure of aggressive adjusters—that becomes our fight, not yours.

This wall of protection lets you heal in peace, confident that a professional is managing the complex legal battle for you. All you need to worry about is your physical and emotional recovery.

Building a Comprehensive Claim for Full Recovery

A successful personal injury claim does more than just pay off your current stack of medical bills. A skilled Texas personal injury lawyer builds a case that accounts for the total impact the accident has had on your life.

We work with medical experts and financial planners to calculate the full scope of your damages, fighting for compensation that covers everything:

- Past Medical Expenses: Every ambulance ride, hospital stay, surgery, and prescription.

- Future Medical Needs: The projected costs of ongoing physical therapy, future surgeries, pain management, and any long-term care you might need down the road.

- Lost Wages and Diminished Earning Capacity: The income you lost while out of work and any impact the injury has on your ability to earn a living in the future.

- Pain and Suffering: Fair compensation for the physical pain and emotional trauma you’ve been forced to endure.

And once a settlement is secured, our work still isn’t over. We then start negotiations with your medical providers and health insurance company to reduce the final amounts they’re owed. This process of negotiating medical bills after a settlement is a critical final step that can significantly increase the amount of money that goes directly into your pocket, helping you secure your financial future.

Common Questions About Car Accident Medical Bills

After a car wreck turns your world upside down, you’re going to have questions. It's only natural. We've put together some straightforward answers to the most common concerns we hear from clients who are in the exact same spot you're in now.

Should I Talk to the Other Driver's Insurance Adjuster?

Our advice is always the same: avoid giving a recorded statement to the other driver’s insurance company before you’ve spoken with a lawyer. Their adjusters are skilled negotiators, and their one and only job is to protect their company's bottom line by paying you as little as possible.

They know exactly what leading questions to ask to get you to downplay your injuries or even accidentally admit some fault. Your Houston car accident attorney will handle every single one of these conversations, protecting you from their tactics and making sure your words can't be twisted and used against you later.

How Long Do I Have to File a Car Accident Claim in Texas?

In Texas, the clock is ticking from the moment of the crash. You generally have two years to file a personal injury claim, a deadline known as the statute of limitations. This isn't a suggestion; it's a hard and fast rule.

If you miss that two-year window, the courts will almost certainly throw out your case, and you'll lose your right to seek compensation forever. That's why contacting a lawyer right away is so important—it gives us time to preserve critical evidence, find and interview witnesses while their memories are still fresh, and make sure every legal deadline is met.

If My Health Insurance Paid My Bills, Do I Get That Money From the Settlement?

Yes, the final settlement is designed to cover the total cost of your medical treatment, including the amounts your health insurance company paid on your behalf.

However, your health insurer has a legal right called subrogation. It’s a fancy term that means they have the right to get paid back out of your settlement for the bills they covered. But here’s the key: a skilled personal injury lawyer doesn't just cut them a check for whatever they ask for. We will fight to negotiate that payback amount down, sometimes significantly, which puts more of the settlement money in your pocket—where it belongs.

What if I Cannot Afford Medical Treatment Right Now?

This is one of the biggest and most understandable fears people have after an accident. You're in pain, but you're worried about how you'll pay for the care you need to get better.

A Texas personal injury lawyer can help. We frequently work with doctors, surgeons, and therapists who agree to treat our clients under what’s called a Letter of Protection (LOP). An LOP is basically an agreement where the medical provider puts a pause on the bills and agrees to get paid directly out of the future settlement. This lets you get the crucial medical care you need right now without any upfront cost, so you can focus on your recovery instead of the bills piling up.

A serious accident can make you feel like you're completely on your own, but you don't have to navigate the legal and financial aftermath by yourself. At The Law Office of Bryan Fagan, PLLC, our team is ready to stand with you, manage the complexities of your claim, and fight for the full and fair compensation you are owed.

We're here to answer your questions and give you the support needed to put your life back together. For a free, no-obligation consultation to discuss your case, please contact us online.