A serious accident can change your life in seconds — but you don’t have to face it alone. Most insurance policies have a clause that requires you to report an accident promptly. While that sounds vague, it typically means you should notify them within 24 to 72 hours. This first call isn't about filing your full claim for damages—that comes later. It's simply the first step to get the ball rolling and protect your right to compensation.

Your First Critical Steps After a Texas Car Accident

One second, you’re driving down a Houston freeway or a quiet suburban street; the next, your life is turned upside down by a crash. The moments that follow are almost always chaotic and confusing, but what you do next is critical—both for your safety and for the strength of any future injury claim you might make.

Your health is always priority number one. Once you're in a safe spot and have called 911 for police and medical help, your focus can shift. The initial report to your insurer is just a heads-up, like raising your hand to say, "Something happened." This simple notification starts the clock on their internal process. Beyond that, knowing the immediate steps after a road accident is key to securing the scene and gathering the early evidence that can make or break your insurance claim.

What to Do Immediately at the Scene

Adrenaline is a powerful thing. It can easily mask serious injuries right after a crash, which is why it's so important to stay as calm as possible and follow a clear plan. These actions create the foundation for your case:

- Prioritize Safety: If you can, move your car to a safe location off the road. Turn on your hazard lights and check on everyone involved.

- Call 911: Always, always report the accident to the police. This is especially true if there are any injuries or significant vehicle damage. A police report is an indispensable piece of evidence.

- Gather Information: Get the names, contact details, driver's license numbers, and insurance policy information from all other drivers.

- Document Everything: Your phone is your best tool here. Take photos and videos of the accident scene from multiple angles, damage to all vehicles, skid marks, road conditions, and any visible injuries you have.

Taking these steps helps create an official record and preserves crucial evidence that will be vital when filing a car accident claim. Our team at The Law Office of Bryan Fagan, PLLC is here to help you figure out what comes next.

How Long Do You Have to File a Claim in Texas?

After a car crash, it can feel like you’re trying to follow two different rulebooks at once. That's because you are. It’s absolutely critical to understand the difference between your insurance company's reporting timeline and the deadline set by Texas law, as they control completely separate parts of your recovery.

Your insurance policy almost certainly has a “prompt notice” clause. This is part of the contract you signed with them, and it requires you to report an accident quickly—often within a few days or as soon as reasonably possible. Think of it like a store's return policy; there's a short, company-set window to act, or you risk losing your right to make a claim with them.

On the other hand, the Texas statute of limitations is a state law, not a company rule. This law gives you a strict two-year deadline from the date of the accident to file a personal injury lawsuit. This is the ultimate cutoff for your legal right to take the at-fault party to court for your medical bills, lost income, and suffering.

Two Timelines Every Accident Victim Should Know

These two clocks are ticking for very different reasons, and ignoring either one can have serious consequences.

- The Insurance Deadline (The "Prompt Notice" Clause): This is all about your contract with your insurer. Miss it, and they could have grounds to deny your claim for vehicle repairs or medical coverage, leaving you to foot the bills yourself.

- The Statute of Limitations (The "Legal Clock"): This deadline protects your fundamental right to sue the person who caused the wreck. If you miss this two-year deadline, the courthouse doors swing shut for good. You permanently lose your ability to seek justice and compensation.

It's a common and costly mistake to think that because you have two years to sue, you also have two years to call your insurance company. That’s not how it works. Notifying your insurer is one of the very first steps, while the statute of limitations is the final, non-negotiable deadline for any legal action.

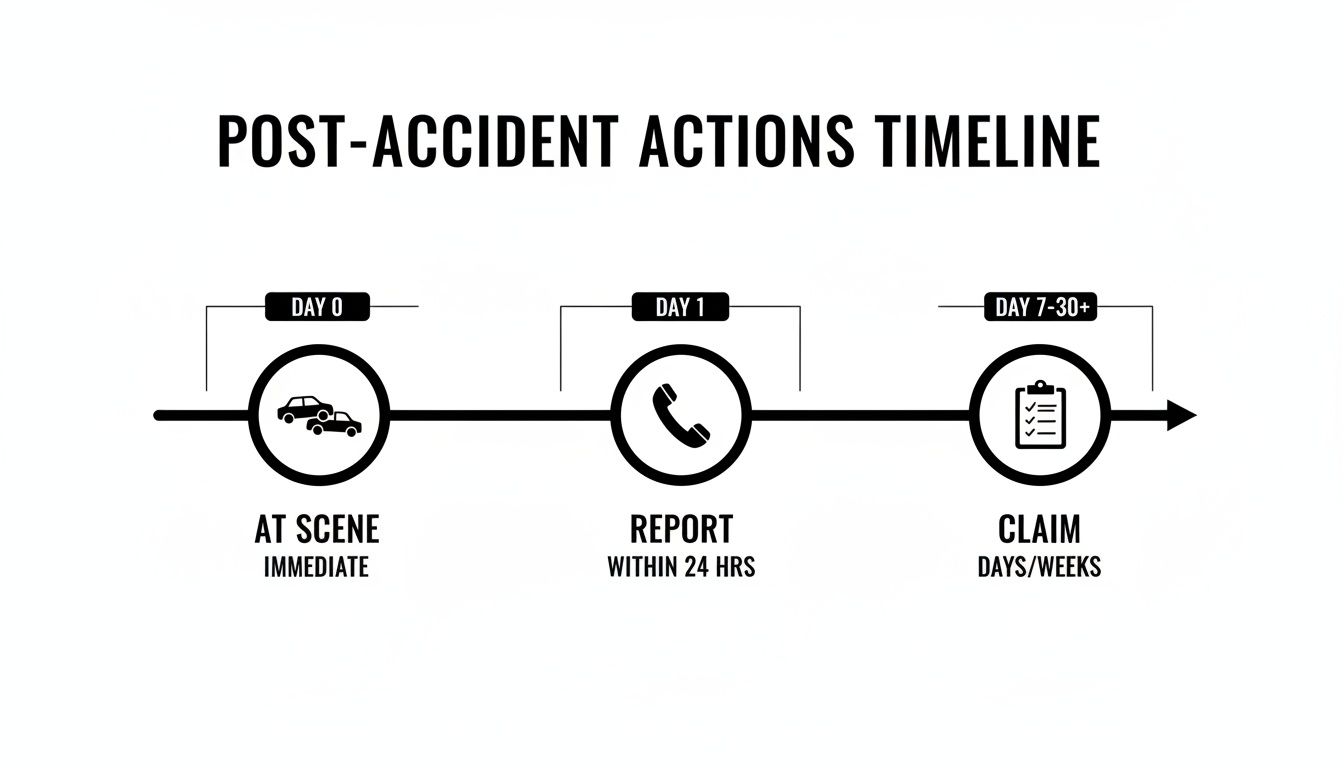

This simple timeline lays out the most important actions you need to take right after a crash.

As you can see, everything starts at the scene, moves quickly to reporting the crash, and then progresses to the formal claim process—all while that final legal deadline looms in the background. To get a deeper dive into how these time limits can make or break your case, check out our detailed guide on the statute of limitations for a Texas car accident.

Why You Can't Afford to Wait to Report Your Accident

In the chaotic moments after a car wreck, the last thing you want to deal with is a phone call to your insurance company. You're shaken, possibly hurt, and worried about your vehicle. But making that call is one of the most critical steps you can take to protect yourself. Putting it off can cause serious problems for your claim.

Insurance adjusters are trained skeptics. When a report comes in days or weeks late, their red flags go up immediately. They might start thinking the crash wasn't that serious, or worse, they could question whether your injuries are even from the accident. A late report hands them an easy reason to be suspicious. Reporting it quickly shuts down those assumptions before they even start.

The Power of a Prompt Report

Acting fast isn't just about checking a box on your policy—it's your first strategic move in building a strong claim. A prompt report locks in an official timeline, making it nearly impossible for the insurance company to argue that your delay hurt their investigation.

Even more importantly, it's a race against time to preserve evidence that can vanish in a flash. We're talking about crucial details like:

- Witness memories: People forget details, or their stories change, the longer you wait.

- Video footage: Security cameras and dashcams often record over old footage within days.

- Scene evidence: Skid marks wash away in the rain, and road crews clear debris quickly.

For example, after a Houston truck crash, we were hired by a family whose loved one had been severely injured. Because they called us right away, we were able to send a demand letter to the trucking company to preserve the driver’s logbooks and the truck's "black box" data before they could be legally destroyed. That one action became the cornerstone of their case, helping them secure the compensation they deserved.

An immediate report isn’t just a formality—it’s the first and most critical step in building a strong foundation for your personal injury claim.

Here in Texas, most insurance carriers expect a call within 24 to 48 hours. While some policies give you up to 30 or 60 days to formally file your claim, don't wait. Acting fast is the single best way to avoid a potential denial. You can get more insights on car accident reporting and see how insurance companies across the board handle these situations.

How to Safely Report an Accident to Your Insurer

Knowing you need to report an accident quickly is one thing; knowing exactly what to say—and what not to say—is how you protect your rights. That first call with an insurance adjuster can feel intimidating, but you are the one in control of the conversation.

Your only real obligation in that initial call is to give them the basic facts of what happened. Think of it as just covering the "who, what, when, and where." You're simply checking a box to fulfill your policy's requirement to give notice of the crash.

What to Say When You Report the Crash

When you pick up the phone, keep your statements simple, factual, and brief. Your goal is just to report the event, not to give a full-blown narrative or your opinion on what went wrong.

- Stick to the Facts: Give them your name, policy number, and the date, time, and location of the accident.

- Identify Others Involved: If you have it, provide the names and insurance information for the other drivers.

- Confirm a Police Report: Let them know a police report was filed and give them the report number if you have it.

That's it. There’s absolutely no reason to volunteer any extra details. An adjuster's job is to look for information that could minimize what the company has to pay out, so the less you say, the better.

Never admit fault, apologize, or guess about what might have caused the crash. Even a simple, well-intentioned "I'm sorry" can be twisted and used against you to assign partial blame under Texas's comparative responsibility laws.

Politely Decline a Recorded Statement

The insurance adjuster will almost certainly ask you for a recorded statement. It's standard procedure for them. You have every right to politely decline this request until you've had a chance to speak with an experienced Texas personal injury lawyer.

Adjusters use these recorded statements to ask leading questions, hoping to get you to say something that weakens your claim down the road.

By keeping your first report brief and factual, you meet your policy obligation without putting your case at risk. For a wider view of the entire process, it helps to understand the general guidelines on how to file an insurance claim effectively.

What Happens If You Miss the Reporting Deadline

A serious accident can flip your world upside down in an instant. If you've waited too long to report the crash, it's completely normal to worry about what comes next. While a delay can definitely complicate things, it doesn't automatically mean your claim is dead on arrival.

Insurance companies can't just deny your claim because you were a few days late. Under Texas law, they usually have to prove that your delay genuinely hurt their ability to investigate the accident. This is a legal concept called prejudice. For example, if your delay meant they couldn't inspect your car before it was fixed or talk to a crucial witness who has since disappeared, they might have a solid reason to deny the claim.

Valid Reasons for a Reporting Delay

But Texas law understands that life doesn't stop after a traumatic crash. You might have a perfectly good reason for not calling right away, and that can make all the difference for your claim.

Some completely understandable explanations include:

- You were hospitalized with catastrophic injuries and were physically unable to pick up the phone.

- The emotional and psychological shock from the accident left you unable to function.

- You were consumed with caring for a severely injured family member, especially in a wrongful death situation.

The real question is whether your reason for the delay was reasonable given the circumstances you were thrown into. An insurance company can't unfairly punish you for a delay caused by the very injuries the at-fault driver gave you.

This is exactly why having an experienced Houston car accident attorney fighting for you is so critical. An attorney can argue that your delay was justified and didn't actually harm the insurance company's investigation. We know how to build a powerful case against an unfair denial and can walk you through all of your options, including how you may be able to appeal a denied insurance claim. Don't lose hope—let us help you fight for the compensation you deserve.

How a Texas Personal Injury Lawyer Can Help Your Claim

After a traumatic accident, the last thing you should have to do is face an insurance company on your own. Juggling all the complex timelines—from prompt insurance reporting to the two-year statute of limitations—is overwhelming, especially when you're just trying to heal. Having a powerful ally in your corner makes all the difference.

An experienced Texas personal injury lawyer takes this entire burden off your shoulders. We immediately step in to handle all communications with insurers, shielding you from adjusters whose only goal is to minimize your payout. Our team gets to work right away gathering critical evidence, from police reports to witness statements, building a powerful case to get you the full compensation you deserve.

Your Recovery Is Our Priority

We know the financial strain that comes with unexpected medical bills and lost wages. It can turn your whole life upside down. That's why we handle all personal injury cases on a contingency-fee basis.

This means you pay us absolutely nothing unless we win your case. There are no upfront costs or hidden fees—our focus is entirely on securing the best possible outcome for you and your family.

Your physical and emotional recovery is what matters most. Let a dedicated Houston car accident attorney fight for your rights so you can concentrate on getting better. We're here to help you take that first step toward justice.

Common Questions About Reporting a Texas Car Accident

Going through the aftermath of a car accident is confusing and stressful, and it’s natural to have a lot of questions. We’ve put together some of the most common ones we hear from clients to give you the clear, direct answers you need.

Do I Have to Report a Minor Fender Bender in Texas?

Yes. It is always a smart move to report any accident, no matter how minor it seems at the time.

What looks like a simple dent could be hiding serious frame damage underneath. On top of that, the adrenaline pumping through your system right after a crash can easily mask injuries that don't show up for hours or even days later. Reporting the crash creates an official record that protects you if the other driver decides to change their story or tries to file a claim against you down the road.

What if the Other Driver Was Uninsured?

If you get hit by a driver who doesn't have insurance, you absolutely need to report the accident to your own insurance company right away. This is the only way to tap into your Uninsured/Underinsured Motorist (UM/UIM) coverage.

The same deadlines for prompt reporting apply here. Getting in touch with a Texas car accident attorney is especially important in these situations, as they can make sure your own insurance company treats you fairly and doesn't try to undervalue your claim.

Will My Rates Go Up If I Report an Accident I Did Not Cause?

Under Texas law, it is illegal for your insurance company to hike up your premiums when you file a claim for an accident that wasn't your fault.

When someone else's negligence causes a crash, reporting it is about protecting your rights. It should not result in a penalty like a rate increase. A Texas personal injury lawyer can step in and help make sure your insurer plays by the rules.

The moments after a crash are overwhelming, but you don’t have to go through the legal maze alone. We want you to know that recovery is possible, and help is available. At The Law Office of Bryan Fagan, PLLC, our experienced personal injury team is here to answer your questions and fight for the compensation you deserve.

Schedule a free, no-obligation consultation today to find out how we can help you move forward.

https://texaspersonalinjury.net