A serious accident can change your life in seconds — but you don’t have to face it alone. Dealing with an insurance adjuster is a delicate dance, and you need to lead. The key is to stick to the facts, never admit fault, and politely refuse to give a recorded statement until you've spoken with a lawyer. Remember, their primary job isn't to make sure you're whole again; it's to protect their company's bottom line.

Your Guide to Navigating Insurance Claims After an Accident

A serious accident flips your world upside down in an instant, but you don't have to navigate the chaos alone. One of the first calls you'll get is from an insurance adjuster, and how you handle it can make all the difference in your physical and financial recovery.

It’s critical to understand their role. The adjuster is trained to investigate your claim with one main goal: keeping the payout as low as possible for their employer. They might sound friendly and concerned, but every question is carefully crafted to find a reason to devalue or deny your claim.

This isn't a small-time operation. The claims adjusting industry has ballooned into a market worth over $14 billion. This massive growth is fueled by an ever-increasing number of claims, which forces insurers to lean heavily on their adjusters to control costs. For you, the accident victim in Texas, that means you're going up against a well-funded, highly trained system designed to protect itself.

Understanding the Adjuster’s Role and Your Rights in Texas

Before you even pick up the phone, your actions at the scene of the crash have already started building the foundation of your claim. If you haven't already, review our detailed guide on what to do after a car accident to make sure you've covered all the essential steps.

When that call from the adjuster finally comes, keep these truths in mind about the process and your rights here in Texas:

- They Work for the Insurance Company. Plain and simple. Their loyalty is to their employer, not to you. Every question they ask is designed to gather information that could potentially be used against your claim.

- You Are in Control of the Information. You have no obligation to give them a detailed, recorded statement right off the bat. You have every right to limit the conversation to the bare-bones facts and give yourself time to understand the full extent of your injuries and explore your legal options.

- In Texas, Fault is Everything. Texas operates under a modified comparative responsibility rule. This is a critical legal concept. If you are found to be 51% or more responsible for the accident, you are barred from recovering any compensation. Adjusters know this, and they will be digging for any statement that could shift even a tiny percentage of the blame onto you.

- Your Words Can Be Twisted. A simple, polite "I'm so sorry this happened" can be spun into an admission of guilt. It's human nature to be apologetic, but in this context, it can be damaging. Stick to neutral, factual statements only.

The First Phone Call: What to Say and What to Avoid

You can bet the at-fault driver's insurance adjuster will call you quickly, sometimes within 24 hours of the crash. They know you're still shaken up, in pain, and probably haven't had a chance to think clearly yet.

When that call comes, the person on the other end will sound friendly and professional. They’ll probably say they just want to "get your side of the story." But make no mistake: their job is to protect their company's bottom line. That means finding ways to pay you as little as possible.

This first conversation is a minefield. To get a better sense of their playbook, it’s helpful to understand how insurance agents manage initial claims calls from their perspective. Knowing their goals helps you stay one step ahead. Your only job in this call is to provide the bare minimum and protect your rights. Anything you say can be twisted and used against you later.

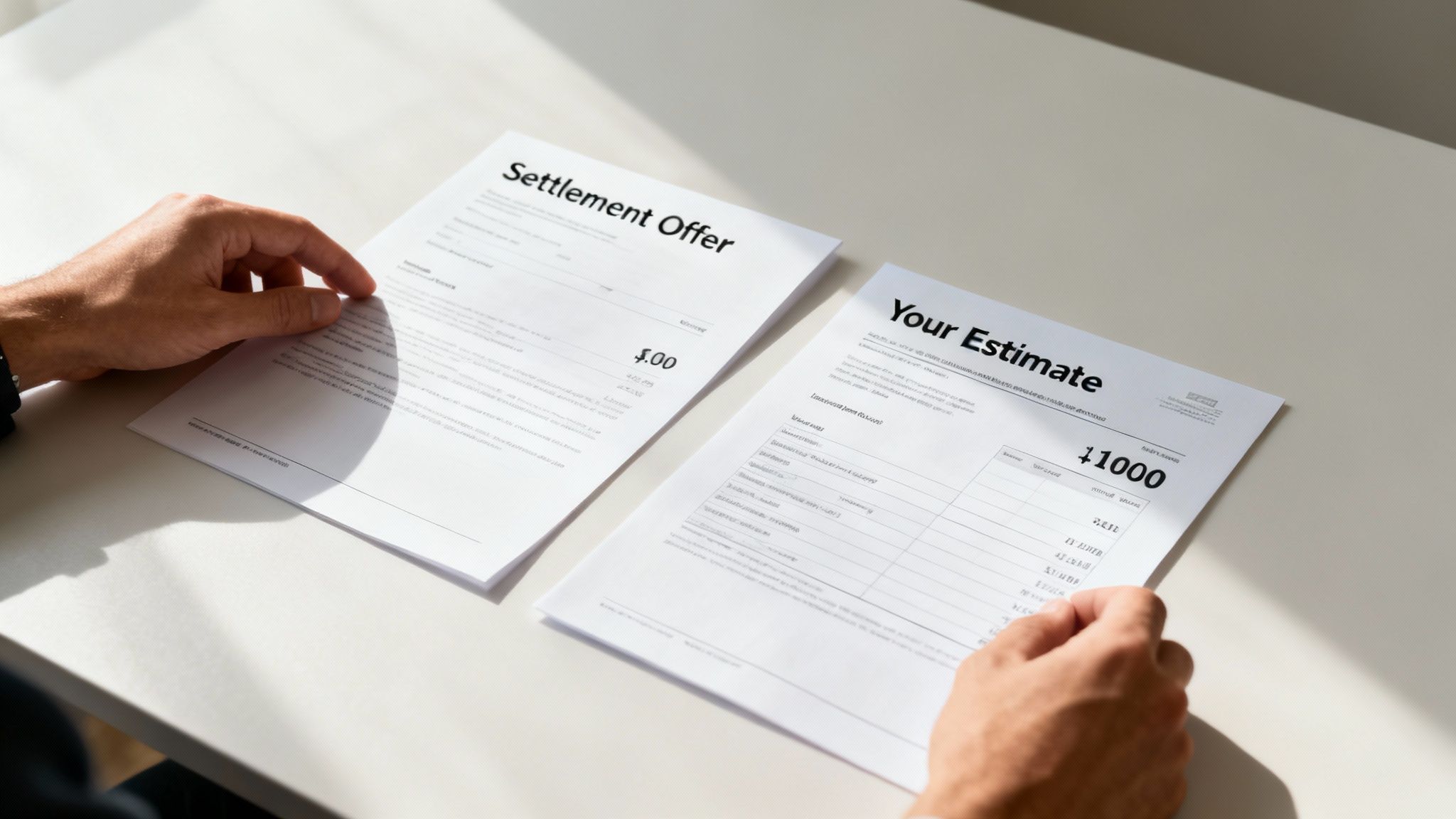

The infographic below really breaks down the conflict of interest at play.

It’s simple: the adjuster wants to close your claim for the lowest amount, while you need to secure fair compensation to cover everything you’ve lost.

Stick to the Essential Facts

When the adjuster calls, be polite but brief. You only need to confirm the most basic details.

Here’s what you should provide:

- Your full name, address, and phone number.

- The date and general location of the accident.

- The kind of vehicle you were driving.

- The name of your own insurance company.

That’s it. You are under no obligation to discuss your injuries, how the wreck happened, or your medical treatment. A perfectly good response is, "I'm still processing everything and I'm not ready to discuss the details right now."

The Recorded Statement Trap

One of the first things the adjuster will ask for is a recorded statement. They'll make it sound like a routine step needed to move your claim forward.

Politely but firmly say no. You are not legally required to give a recorded statement to the other driver's insurance company.

Adjusters are trained to ask tricky, leading questions. A recorded statement locks in your answers before you fully understand the extent of your injuries or have spoken with a Texas personal injury lawyer.

Think about it. Say you were in a pile-up on I-35 in Austin. The adjuster might ask, "So you were able to walk around and talk to people after the crash, right?" If you say "yes," they'll later argue your injuries couldn't have been that bad—even if whiplash or a concussion didn't show up for a few days.

A simple, "I'm not comfortable providing a recorded statement at this time," is all you need to say.

Words and Phrases That Will Hurt Your Claim

In Texas, we have a law called modified comparative responsibility. It means if you are found to be 51% or more at fault for an accident, you get nothing. Zero. Adjusters are listening for any little thing you say that suggests you share even a tiny bit of the blame.

To help you navigate this critical conversation, here is a quick guide on what to say and what to avoid.

What to Say vs What Not to Say to an Adjuster

This table is your cheat sheet for that first phone call. Sticking to the "Safe to Say" column protects your claim, while the phrases in the "What to Avoid" column can give the insurance company ammunition to use against you.

| Safe to Say to Protect Your Rights | What to Avoid Saying to an Adjuster |

|---|---|

| "I need to get your name, phone number, and claim number." | "I'm sorry." (This can be interpreted as an admission of fault, even if you're just being polite.) |

| "The accident happened on [Date] at [Location]." | "I'm fine," or "I'm okay." (Adrenaline masks injuries. You don't know the full extent of them yet.) |

| "I am getting medical treatment." | "I think the other car was going…" or "Maybe I could have…" (Never guess or speculate.) |

| "I was injured and am still assessing my injuries." | Specific injury details like "My neck is just a little sore." (This can be used to downplay your pain.) |

| "I am not prepared to give a recorded statement at this time." | Giving a recorded statement at all. (You are not required to give one to the other party's insurer.) |

| "I can confirm my basic contact information." | Any details about your work, income, or past injuries unless advised by your attorney. |

| "I will have my attorney contact you," or "I am seeking legal advice." | "It was my fault," or any language that accepts blame. |

Remember, the goal is to be a broken record: stick to the facts you know for sure and politely decline to discuss anything else. Controlling the flow of information is your best defense in these early stages.

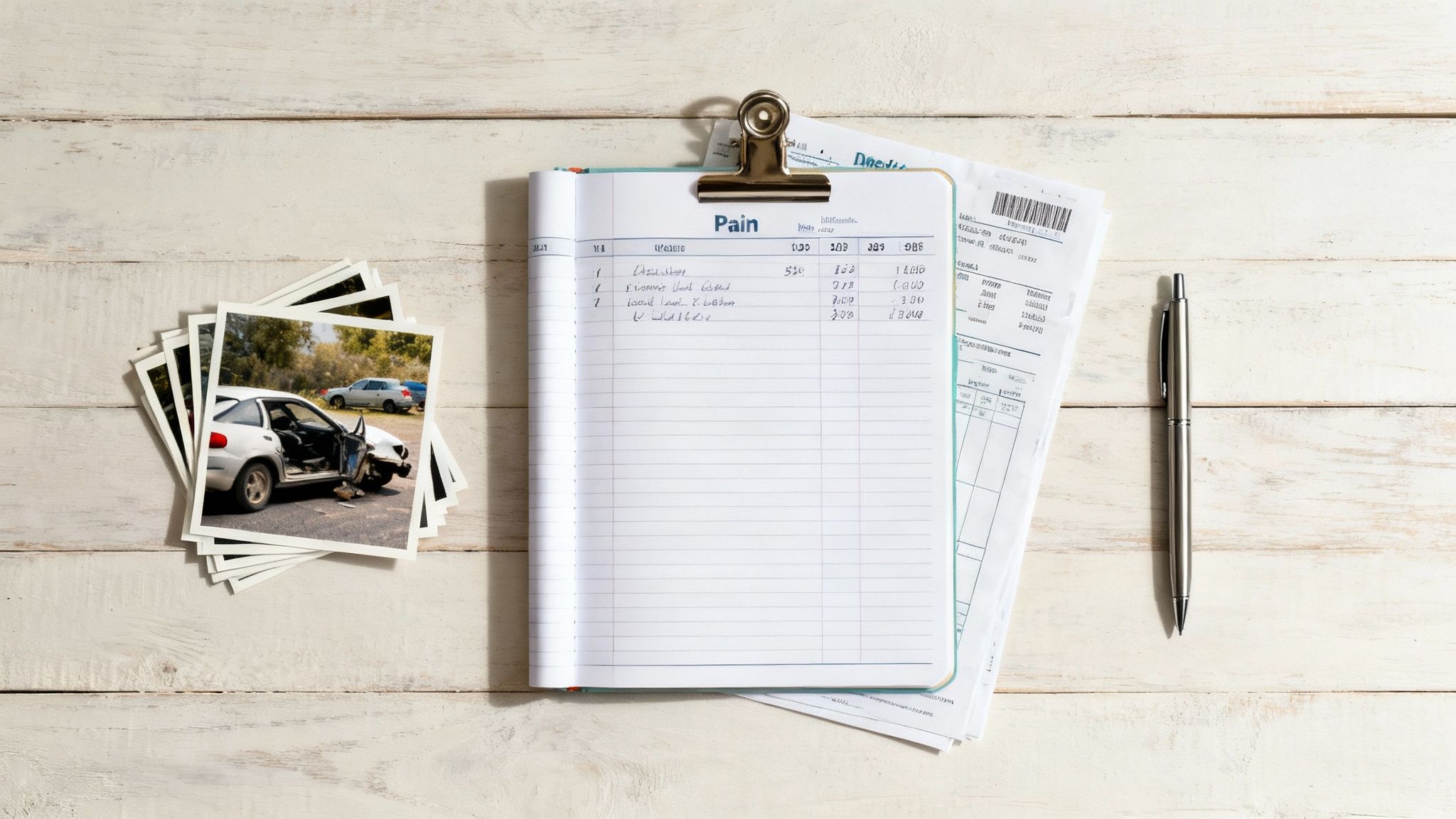

Documenting Your Case for a Fair Settlement

When you're up against an insurance company, strong, organized documentation is the single most powerful tool you have. It’s what turns your story into an evidence-backed case they can’t ignore. Facts, not feelings, are what force a fair settlement.

Think of it this way: an adjuster’s job is to poke holes in your claim. They look for any inconsistency or gap that gives them a reason to offer you less. The more thorough your records, the less room they have to argue.

Preserve Evidence from the Accident Scene

The foundation of your entire claim is built in the minutes and hours right after the crash. We know adrenaline is pumping and it’s a chaotic time, but the details you can capture at the scene are absolutely vital.

This initial evidence is what establishes how the accident really happened. That’s a huge deal in Texas because of our modified comparative responsibility rule. If you’re found to be 51% or more at fault, you get nothing. Zero. Clear photos and witness info from the scene can stop the other driver’s insurer from twisting the facts and pinning the blame on you.

Here’s what you need:

- Photos and Videos: Don’t just snap a picture of the dents. Get wide shots of the intersection, skid marks, traffic lights, and road conditions. The more angles, the better.

- Witness Information: Get the name and number of anyone who saw what happened. An independent voice backing up your version of events is incredibly persuasive to an adjuster.

- The Official Police Report: This is often the first thing an adjuster asks for. It's a neutral, third-party summary that sets the stage for your entire claim.

Create a Detailed Pain and Recovery Journal

Your medical bills show the cost of your treatment, but they don't show the impact. A pain and recovery journal is where you document the daily, human toll the accident has taken on your life.

This isn’t just about charting physical pain on a scale of 1 to 10. It’s about the real-life consequences. How has this affected your sleep? Your mood? Your ability to work, play with your kids, or just get through the day? Be specific and be consistent.

A journal entry that reads, "Couldn't lift my daughter today because of sharp back pain and felt incredibly frustrated and sad," is far more compelling to an adjuster than simply saying your back hurts.

These personal, detailed accounts are what justify compensation for non-economic damages—like pain and suffering—which are a critical part of making you whole again.

Organize Every Bill and Financial Record

Every single dollar you've spent or lost because of this accident needs to be tracked. We tell every client to get a dedicated folder or create a digital one right away. It might seem like a lot of paperwork, but you'll thank yourself later. For some helpful tips, check out these proven strategies for organizing your files.

Make sure your financial file includes:

- Medical Bills: Everything. The ambulance ride, the ER visit, prescriptions, physical therapy co-pays—it all adds up.

- Repair Estimates: Keep every quote and the final invoice for your vehicle repairs.

- Proof of Lost Wages: You’ll need more than just a note saying you missed work. Get a letter from your employer confirming your pay rate and the exact hours you missed, backed up by your pay stubs.

This level of detail is non-negotiable, not just for the adjuster but also for when you officially file your car accident claim with the insurance company. Knowing how to submit everything correctly from the start can prevent massive delays.

A well-documented file makes it easy for the adjuster to justify a fair settlement to their manager. According to the U.S. Bureau of Labor Statistics, the median salary for a claims adjuster is around $76,790, and those who handle more complex cases often earn more. A neat, complete, and undeniable package of evidence gives them the ammunition they need to close your file and move on.

Evaluating and Responding to Settlement Offers

After weeks of sending documents and leaving voicemails, the adjuster finally makes a settlement offer. It’s a moment of relief, but it's also one of the most dangerous points in your claim. From our experience, we can tell you: the first offer is almost never the insurance company's best offer.

In reality, it's a strategic move. The adjuster is testing your resolve, hoping you'll accept a quick, low payout out of frustration or financial pressure. They are banking on the fact that you don't fully understand the total value of your claim, which is much more than just your current stack of medical bills.

Understanding the Full Value of Your Claim

In Texas, your personal injury claim is typically divided into two main categories of damages. That first offer from the insurance company almost never accounts for the full extent of both.

- Economic Damages: These are the straightforward, calculable losses. Think of them as anything with a receipt or an invoice attached—medical bills, lost wages from missed work, and the cost to repair or replace your vehicle.

- Non-Economic Damages: This is the human cost of the accident. It covers your physical pain, emotional distress, mental anguish, and the loss of enjoyment of life. These damages are harder to put a number on, but they are just as real and every bit as important.

An adjuster’s initial lowball offer often focuses only on the economic damages they can't dispute, like the bill from the emergency room. It conveniently ignores your future needs and the profound impact the wreck has had on your daily life.

A Real-World Example of a Lowball Offer

Let’s put this into perspective. After a Houston freeway crash, you were seriously injured by a semi-truck on I-10. The initial hospital stay and surgery cost $50,000. You’ve been out of work for two months, losing $8,000 in wages. The insurance company offers you $60,000, claiming it covers your costs and gives you a little extra.

At first glance, it might seem reasonable. But this offer is a trap. It completely ignores that your doctor has recommended a second surgery in six months and at least a year of physical therapy. It fails to compensate you for the chronic pain that keeps you up at night or the fact that you can no longer go fishing on the weekends.

Accepting that initial offer would mean you are personally on the hook for all future medical costs and would get nothing for your ongoing pain and suffering.

How to Analyze and Respond to an Offer

Before you even think about responding, you must have a clear picture of your total losses—both current and future. Never, ever accept a settlement while you are still actively receiving medical treatment for your injuries.

Once you sign that settlement release, your claim is closed forever. If you later discover you need another surgery or your injuries are permanent, you cannot go back and ask for more money. It’s a final decision.

When you get that offer, compare it meticulously against your documented losses. Does it cover every single medical bill, every lost paycheck, and every out-of-pocket expense? More importantly, does it provide fair compensation for your future needs and your non-economic damages?

If the offer is too low—and the first one almost always is—your response should be a firm but professional rejection. This is usually done through a counteroffer, backed up by all the detailed documentation you’ve been gathering. This is the point where having a skilled truck crash lawyer Houston becomes invaluable. An attorney can accurately calculate the full value of your catastrophic injury or wrongful death claim and handle all negotiations, making sure the adjuster takes your demand seriously.

Your recovery is the priority. Dealing with an insurance adjuster who is actively working against your best interests shouldn't be your burden. If you've received an offer that feels unfair, let us review it for you. Schedule a free, no-obligation consultation with The Law Office of Bryan Fagan, PLLC, and let our experience work for you.

When You Need a Lawyer on Your Side

You might be able to handle a minor fender-bender claim on your own. But the game changes entirely when you’ve been seriously injured. A high-stakes personal injury case isn’t a DIY project; it's a battle against a well-funded corporation whose only goal is to pay you as little as possible.

Knowing when to call a Texas personal injury lawyer is one of the most critical decisions you will make.

The moment an experienced attorney gets involved, the whole dynamic shifts. The insurance adjuster knows they can no longer use their standard playbook of delay, deny, and defend. Suddenly, they're dealing with a professional who understands Texas law, knows how to calculate the true value of a claim, and is ready to go to court if they don't get a fair offer.

Clear Signs You Need Legal Representation

If you find yourself in any of these situations, it's a clear signal that you need to protect yourself by bringing in a legal advocate. Trying to handle these cases alone can jeopardize both your physical and financial recovery.

Imagine a catastrophic injury from a truck crash on I-45. The victim’s injuries demand multiple surgeries and lifelong care. The adjuster’s first offer might not even cover the initial hospital bill, let alone the millions needed for future medical treatment, lost earning potential, and a lifetime of pain.

You absolutely need a lawyer if:

- Your injuries are serious or permanent. This includes catastrophic injuries like brain trauma, spinal cord damage, or severe burns that will require long-term care.

- The insurance company disputes fault. Texas uses a modified comparative responsibility rule. If an adjuster can pin 51% or more of the blame on you, you get absolutely nothing. An attorney can hire accident reconstruction experts to prove what really happened.

- The settlement offer is ridiculously low. If their offer doesn't cover all your medical bills, lost wages, and future needs, it’s not a fair offer. It's an insult. A lawyer will calculate the full value of your claim, including pain and suffering.

- You are claiming wrongful death. Losing a loved one is a devastating, life-altering event. A wrongful death lawyer Texas can handle the complex legal filings and fight for justice for your family, giving you the space you need to grieve.

The Power of an Attorney in Negotiations

An attorney does so much more than just send letters. They take over all communication, shielding you from the adjuster's constant pressure and probing questions. They manage every deadline, gather critical evidence, and build a case so strong that the insurance company is often forced to the negotiating table in good faith.

The insurance industry itself is changing. While claims are going up, the number of human adjusters is projected to decline. Why? Because automation and AI systems are being used to spit out initial, often insultingly low, settlement calculations. You can read more about this trend and what it means for people like you on CarrierManagement.com. This shift makes having a real human advocate on your side more critical than ever.

An experienced lawyer completely levels the playing field. They have the resources to bring in medical experts, economists, and investigators to build an undeniable case for the compensation you deserve.

On top of everything, you have to watch the clock. In Texas, you generally have just two years from the date of the accident to file a personal injury lawsuit. This is called the statute of limitations. If you miss this deadline, your right to seek compensation is gone forever.

Waiting too long also means evidence disappears and witness memories fade, which only weakens your case. If you're unsure about the process, you can learn more about when to hire a personal injury lawyer in our detailed guide.

You've been through enough. You don't have to face a powerful insurance company alone. At The Law Office of Bryan Fagan, PLLC, we handle the legal fight so you can focus on healing. Your recovery is possible, and we are here to help you achieve it.

Common Questions About Dealing with Adjusters

After a serious crash, your head is spinning. You’re hurt, you’re stressed, and now the insurance company is calling. It’s natural to feel uncertain about what to do next, but getting clear, straightforward information is the first step toward taking back control.

Here are some of the most common questions we hear from Texas accident victims when they start dealing with insurance adjusters. The answers are direct and practical, designed to help you protect yourself.

Do I Have to Give a Recorded Statement?

No. Let us be clear: you are not legally required to give a recorded statement to the other driver's insurance company. You have no obligation to do so.

Think of it this way—adjusters are highly trained interviewers. Their job is to protect their company's bottom line, and they know how to ask leading questions designed to trip you up. They might ask something that sounds innocent, like, "You were just a little sore after the crash, right?" If you agree, they can twist that statement later to argue your injuries weren't serious, even if debilitating pain set in days later.

The best response is to politely and firmly decline until you've spoken with a Texas personal injury lawyer.

You can simply say, "I'm not comfortable providing a recorded statement at this time." This one sentence is a powerful tool. It protects you from getting locked into a story before you even know the full extent of your injuries and legal options.

Should I Sign a Medical Authorization Form?

Be extremely cautious here. Before you sign any medical authorization form from the at-fault driver's insurance company, you need to understand what you're giving them.

These documents are often intentionally broad, granting the adjuster unrestricted access to your entire medical history—not just the records related to this specific accident. Their goal isn't to help you; it's to go on a fishing expedition. They want to dig for any pre-existing conditions or prior injuries they can use to claim your current pain is from something else.

Never sign one of these forms without having a Houston car accident attorney review it first. Your lawyer can ensure it's strictly limited to only the records relevant to your current claim, shutting down any attempt to invade your private health information.

What if the Adjuster Is Ignoring Me?

It’s frustrating, but this is a classic insurance company tactic. By ignoring your calls and dragging out the process, they're hoping you'll get so desperate that you either give up or accept the first lowball settlement they throw your way.

If an adjuster is consistently unresponsive, take it as a major red flag. This isn't just poor customer service; it could be a sign of bad-faith insurance practices under Texas law. An experienced truck crash lawyer in Houston knows how to handle this. We can step in immediately by sending a formal letter of representation, which legally forces the insurer to respond and deal with your claim professionally. An attorney makes them accountable.

How Long Do I Have to File a Claim in Texas?

In Texas, the deadline for filing a personal injury lawsuit is set by a law called the statute of limitations. For most cases, you have two years from the date of the accident to file.

While a few rare exceptions exist, this two-year deadline is absolute. If you miss it, the court will almost certainly throw out your case, and you will lose your right to seek any compensation for your injuries—forever.

Don't wait until the last minute. Contacting an attorney soon after your accident is the best way to ensure that all deadlines are met, crucial evidence is preserved while it's still fresh, and your case is built on a strong foundation from day one.

A serious injury can feel like a lonely journey, but you don’t have to face the legal and financial aftermath by yourself. At The Law Office of Bryan Fagan, PLLC, our compassionate and experienced attorneys are here to handle the insurance companies so you can focus on what matters most—your recovery. We invite you to schedule a free, no-obligation consultation to discuss your case and learn how we can help you fight for the justice and compensation you deserve. Visit us at https://texaspersonalinjury.net or call us today to take the first step.